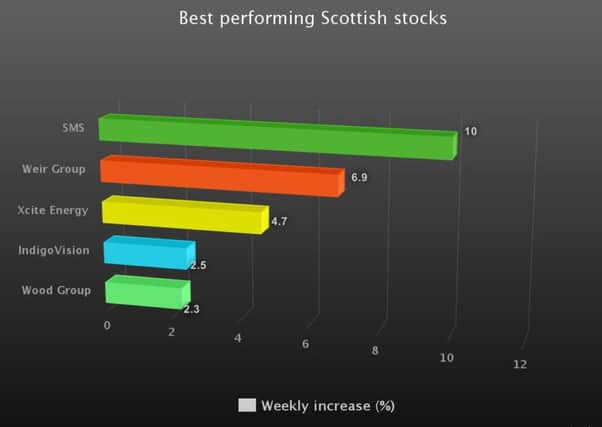

Top five performing Scottish stocks last week

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

SMS +10%

The Glasgow-based supplier of smart energy meters hiked its interim dividend by a quarter to 1.37p a share after unveiling a 15 per cent rise in first-half underlying pre-tax profits to £9.2 million. The growth in earnings was sparked by a 25 per cent jump in revenues to £32.3m. Following a string of recent acquisitions, SMS now manages more than one million utility metering and data assets on behalf of energy suppliers in the industrial, commercial and domestic markets.

Shares closed at 539.5p on Friday 23 September and at 593.5p on Friday 30 September

Weir Group +6.9%

Advertisement

Hide AdAdvertisement

Hide AdJohn Heasley was today unveiled as the Glasgow-based engineering group’s new chief financial officer with immediate effect. He succeeds Jon Stanton, who has replaced Keith Cochrane as the firm’s chief executive. Heasley, who joined Weir in 2008 and has been managing director of its flow control division since 2014, said it was “an honour to be appointed chief financial officer and to join the board of one of the world’s great engineering businesses”.

Shares closed at 1,591p on Friday 23 September and at 1,700p on Friday 30 September

Xcite Energy +4.7%

The North Sea oil company said that holders of $135m (£105m) in senior secured bonds had agreed to push back the maturity date of the debt and the interest payments. The move came after Aberdeen-based Xcite said its bondholders were set to be handed 98.5 per cent of the company’s shares in a debt-for-equity swap that would represent a “very significant dilution to existing shareholders”, but it stressed that this would be “in the best interests of the company”.

Shares closed at 2.13p on Friday 23 September and at 2.23p on Friday 30 September

IndigoVision +2.5%

The Edinburgh-based video security specialist overcame “highly competitive” market conditions to report a sharp reduction in first-half losses. The Aim-quoted firm said revenues for the six months to the end of June fell 3.5 per cent to $21.8m as camera prices across the market fell in response to “substantial” price cuts by a number of manufacturers in the Far East. However, its camera volumes grew 20 per cent, driven by strong growth in healthcare, education, finance and “safe cities” projects in the Middle East.

Shares closed at 161.5p on Friday 23 September and at 165.5p on Friday 30 September

Wood Group +2.3%

Offshore workers voted to accept a proposal ending an industrial dispute that led to the first North Sea strike of its kind in a generation. Unite members working on Shell platforms took industrial action after rejecting proposed cuts in pay and allowances by Wood Group, the Aberdeen-based energy services giant. Unite regional officer John Boland said: “Our negotiations with Wood Group allowed us to reduce the levels of cuts being proposed to our members’ wages and terms and conditions.”

Shares closed at 742.5p on Friday 23 September and at 759.5p on Friday 30 September