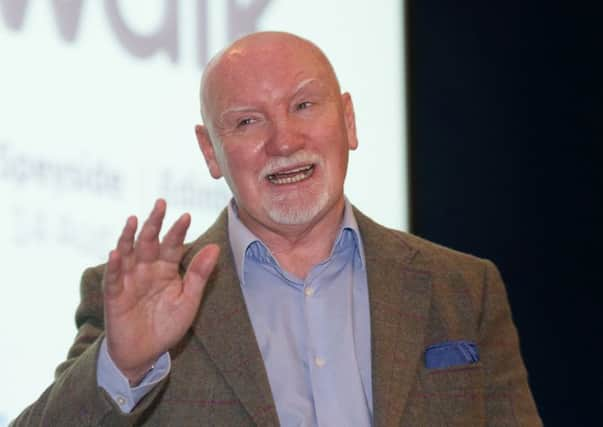

Sir Tom Hunter to press button on major online drive

Hunter said WCC will commit “multi-millions” between now and Christmas, starting with today’s announcement of follow-on funding for DynamicAction. It has developed a system for retailers that links data across merchandising, marketing, operations, customers, returns and finance – both from physical stores and electronic sales – to create a list of actions ranked by how much each will boost overall profitability.

WCC and Accenture, the global professional services company, will provide the bulk of $15 million (£11.3m) to boost DynamicAction’s R&D activities while also expanding sales and marketing. The deal includes an alliance in which Accenture will become a reseller and service provider for the company’s analytics products. John Squire, chief executive and co-founder, said DynamicAction will also build products specific to Accenture.

Advertisement

Hide AdAdvertisement

Hide AdThe deal follows a period of rapid growth for the start-up, with revenues up 172 per cent year-on-year and nearly doubled client renewal revenues. Customers include Tesco, Brooks Brothers and Nine West.

It is the biggest cash injection this year by WCC, which remains DynamicAction’s largest shareholder. Hunter, who made his original fortune in 1998 by selling Sports Division to JJB Sports, said WCC is now focused online after selling its remaining stake in its last bricks and mortar retailer, House of Fraser, in 2014.

“I am an old-school retailer, and I am learning more from these guys than they are learning from me, because the change in retail is so fast-paced,” he said of DynamicAction. “This is just one of a few announcements we are going to make between now and Christmas in this area.”

WCC’s original investment in DynamicAction stems from the establishment of retail systems integrator eCommera in 2006. That was headed by Michael Ross, who had done business with Squire’s previous company and the two became friendly as a result.

They started discussing the idea for DynamicAction in 2008, and with support from Hunter they began working on it in 2012. The systems integration operations of eCommera were sold by WCC in 2015 to Japanese-owned marketing agency Dentsu Aegis, allowing the team to focus solely on DynamicAction.

Squire, a former chief strategy officer with computer giant IBM, said Hunter had been a “very patient” backer. Other existing minority investors include London-based Frog Capital, communications group WPP and growth investor ePlanet Capital.

“The seeds for this have always been in Tom’s mind, because he is the kind of guy that can see pretty far out into the future,” Squire said.