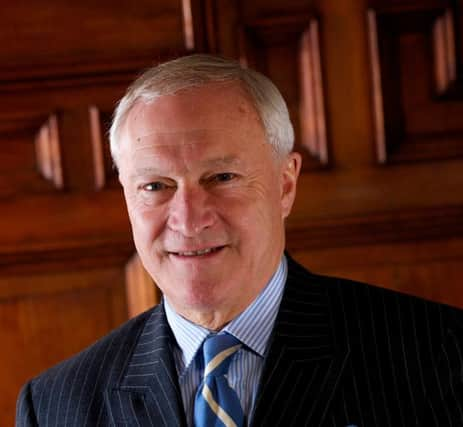

Ray Entwistle looks to step down from board of Hampden & Co

Entwistle, 74, moved to Scotland in 1977 to set up Lloyds Bank’s first branch in Edinburgh. He had chaired Adam & Company before deciding to set up a new private bank in 2010, which then launched as Hampden & Co three years ago with offices in Edinburgh’s Charlotte Square, as well as in Mayfair, London.

He intends to step down from the board of Hampden & Co later in the year. The selection of his successor as chairman will be led by senior independent director, Alex Hammond-Chambers – the former executive chairman of investment management firm Ivory & Sime.

Advertisement

Hide AdAdvertisement

Hide AdEntwistle said: “I was being described as a ‘veteran banker’ in the media before Hampden & Co even opened. This past three years have been exciting, fuelled by clients who continue to write to me to say what a pleasure it is to have found a bank that acts with decency and integrity.

“I will continue to be involved with Hampden & Co. The new chairperson will bring new energy to the development of our mission to create ‘The Private Bank for the 21st Century”.

Hampden & Co’s chief executive, Graeme Hartop, said: “Ray has been instrumental and inspirational in the set-up of Hampden & Co and we would not be where we are today without his vision and tenacity. I am delighted that he will continue to be involved in his role as founder.”

Last month, the bank said it was entering the intermediary mortgage market after inking a partnering deal.

It agreed a tie-up with Paradigm Mortgage Services, noting that the mortgage arrangements of many of its high net worth clients can “frequently be complex”.

Hartop, who is a former managing director at Scottish Widows Bank, said: “Approximately 75 per cent of residential mortgage business is via the intermediary market with many of these clients being high net worth individuals who don’t necessarily fit with high street bank’s lending formulas.

He also noted that the closure of bank branches and the switch to internet banking and automated advice had led to “a very de-personalised banking experience”, adding: “Many successful people still value a personal, professional service. That’s what we do, and it’s working.”

Hampden recently reported results which revealed that income increased to £3.9 million during the year – a rise of 138 per cent – although that was offset by costs rising 30 per cent to £10.3m.

Loans to clients grew by 96 per cent to £94.2m and deposits by 35 per cent to £194.6m.