Libor manipulation laws set to be extended

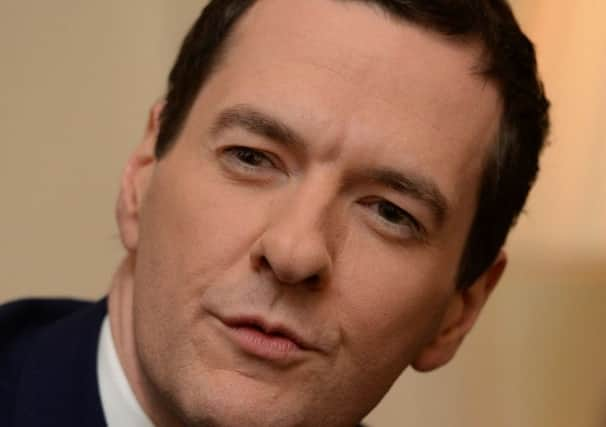

Chancellor George Osborne said yesterday: “Ensuring that the key rates that underpin financial markets here and around the world are robust, and that anyone who seeks to manipulate them is subject to the full force of the law, is an important part of our long-term economic plan.”

The move is the latest by the Conservative-led government to clamp down on malpractice in the City of London, whose reputation has been tarnished by an interest rate-rigging scandal and claims that traders colluded to manipulate currency rates.

Advertisement

Hide AdAdvertisement

Hide AdUnder existing law, people found guilty of manipulation of benchmark rates can be handed jail sentences of up to seven years. It was originally introduced to cover the London Interbank Offered Rate (Libor) market – the rate at which banks lend to each other – after a global manipulation scandal which resulted in banks being fined billions of dollars.

Libor is used as a benchmark against which the terms of $350 trillion of financial contracts are set, including mortgages and the cost of business lending.

The Treasury said yesterday seven new benchmark rates would be subject to the law, pending a consultation by financial regulators. The European Union has criminalised the rigging of financial market benchmarks after the Libor scandal, but those laws are not due for implementation until 2016.

SUBSCRIBE TO THE SCOTSMAN’S BUSINESS BRIEFING