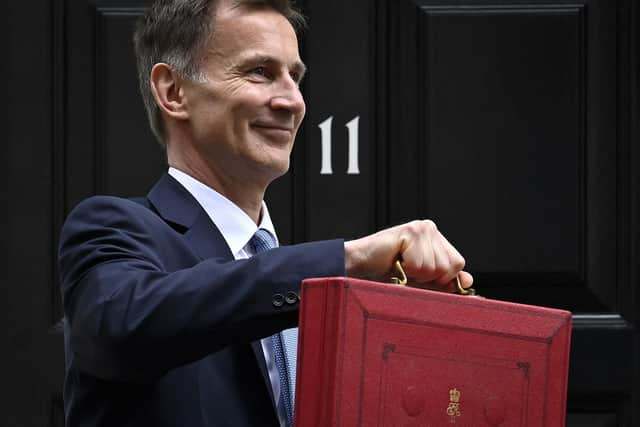

Jeremy Hunt is weighing up tax cuts as Budget day approaches - Vishal Chopra

Just like the Scottish Government being faced with reconciling spending ambitions with fiscal constraints, Chancellor Jeremy Hunt, in a matter of days, has to decide on making potential cuts to both personal and business taxes and the impact they could have in the short and long term – keeping in mind that this could be his last chance to seize the moment before an election is called and takes place.

Most urgent is the painful but opportunistic fiscal drag successive Chancellors have achieved by fixing tax rate thresholds. With inflation subsiding a little, now might be the time to unfreeze them. It’ll be expensive, but has the advantage of giving voters a real benefit in their pockets in an election year. Of course setting income tax bands above the personal allowance and income tax rates is devolved in Scotland, so it would be interesting to see how the Scottish Government would respond to any such move.

Advertisement

Hide AdAdvertisement

Hide AdLess expensive but more complicated is dealing with the big distortions in the tax system that are keeping people out of the labour market or businesses from growing. Hunt made a start last year with the abolition of the pensions lifetime allowance but there are bigger distortions still remaining. For individuals the most troublesome income bands are around £50k when parents face the 40 per cent higher rate combined with the High Income Child Benefit Charge, and just above £100k where the personal allowance starts to taper and free child care is removed. Both could be eliminated by dropping those tapers or raising the level at which they kick in, but of the two the £50k child benefit charge is more voteworthy. It would cost money but bring marginal rates closer to sensible levels.

The £85k VAT threshold is a much tougher nut to crack. Reduce it and thousands of small businesses owners won’t say thanks. Increase it and you just defer the problem.

Finally, there are the two big distortions between how different types of people are taxed. Capital gains are taxed at much lower rates than income, and the self-employed are taxed more favourably than employees. Fixing either creates winners and losers, but at some point it needs doing. I don’t think the Chancellor will go there, but if he’s really thinking about legacy then don’t rule it out.

Pulling all of this together, will it mean no giveaways that grab our attention? It’s an election year so I am sure there will be something. However, don’t expect this in the form of the end of Inheritance Tax or the dropping of the 45p additional rate. How about one last shot at a legacy for this Government? This could be in the form of the Corporation Tax rate falling below 25 per cent again.

Only time will tell but history shows us that Chancellors typically cut taxes in the run-up to a general election and then increase them at the start of the next parliament.

Vishal Chopra, Head of Tax – Scotland – KPMG

Comments

Want to join the conversation? Please or to comment on this article.