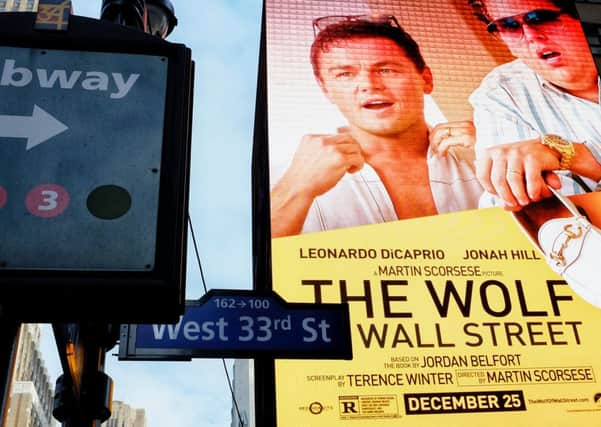

Jeff Salway: Report scamming stock market wolves

So far, so very believable (and it is based on a true story). What’s more unusual is that he was eventually caught and ended up in jail.

Belfort ran a brokerage firm which specialised in cold-calling investors to con them into buying stocks that it already held.

Advertisement

Hide AdAdvertisement

Hide AdWhen the price of the stocks rose the brokers would sell out, leaving their customers with worthless pieces of paper.

He was eventually caught and served almost two years in jail. But brokers cold-calling investors selling worthless shares continue to thrive, both in the UK and elsewhere.

As the main story on this page explains, so-called boiler room scams are collecting victims by the week.

They are typically slick and persuasive, sufficiently professional and convincing to lure smart, often sophisticated investors into their trap. Their sales pitch can seem both compelling and plausible.

They are also elusive, which means most of their victims never see their money again. The way they operate makes it difficult for the authorities to pin them down, with many operating overseas and using UK mail drop addresses.

Some have been caught out. Three British men were jailed in Florida last summer after being found guilty of conning £80 million out of more than 2,300 UK investors by flogging them worthless shares in US companies.

But while that case gives us an idea of the scale of boiler room fraud, it’s a rare example of justice being done. The fraudsters that ripped off Scotland on Sunday reader Craig Jamieson and thousands of others continue to target innocent investors today.

And it doesn’t end there. Because victims of boiler rooms are being targeted by similarly unscrupulous “fraud recovery” firms claiming to help them get their money back.

Advertisement

Hide AdAdvertisement

Hide AdIt’s an echo of the way in which claims management companies have exploited the PPI scandal.

In some ways, however, it’s worse – the investors ripped off by boiler rooms have lost thousands and have little chance of getting their money back.

Their desperation plays right into the hands of recovery fraud firms – sometimes the people behind the original rip-off, or tipped off by other boiler rooms – who approach victims purporting to be able to help them recoup their losses.

Invariably they charge a fee – or even several fees – for their services before staging a disappearing act without helping investors recover any of their money.

It’s all familiar and it’s effective. People are still being targeted by the Belforts of today not only because it’s a lucrative business, but because most of them are getting away with it.

That’s partly because most victims keep it quiet, perhaps because of shame or embarrassment.

Jamieson contacted Scotland on Sunday because he doesn’t want others to suffer the same fate.

If you think you’ve been hit by an investment scam, swallow your pride and report it.

Twitter:@vaughansalway