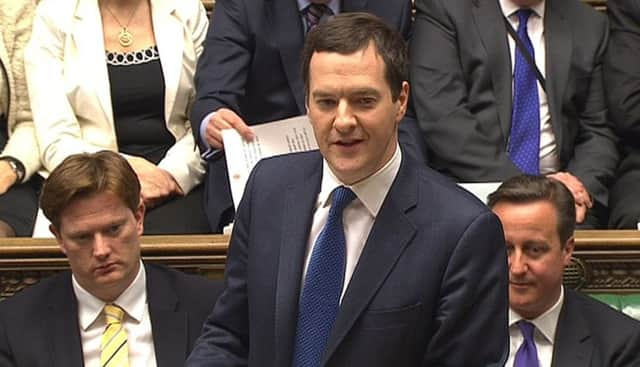

Jeff Salway: George Osborne’s breathtaking bribe

Fast forward three years and the same government is now telling people they can do whatever the hell they like with their pension savings. Don’t worry if you run out of money because you splashed it on fast cars, says the pensions minister, you can always fall back on the state pension.

This is a bizarre message from a government that wants to encourage pension saving and reduce dependence on state support. As a volte-face – and as an example of principles coming a distant second to politics when an election looms – it’s quite breathtaking. It’s also downright reckless.

Advertisement

Hide AdAdvertisement

Hide AdFor the purpose of balance, let’s be clear that there are plenty of positives. Annuities reform was desperately overdue. Pressure has been mounting on annuity providers to get their house in order and they’re now paying the price for their failure to do so.

But George Osborne, never one for the unintended consequences, has let the risk pendulum swing too far the other way. I certainly wasn’t alone in seeing the words “mis-selling scandal” flash in front of my eyes as the scale of the reforms sunk in.

By giving savers more freedom with their pension pots Osborne has kickstarted a wholesale transfer of risk to the individual.

That extra freedom places a greater “burden of responsibility for individuals to understand” the choices they make, as the National Association of Pension Funds pointed out.

It added, correctly, that the UK has a financial literacy shortfall, warning that the reforms “will leave a large swathe of people vulnerable to poverty in old age”.

Plenty of people are perfectly capable of managing their own finances, and successfully.

But is the average saver really capable of managing their retirement finances to ensure their savings last for as long as they need them, factoring in longevity assumptions, changes to circumstances, risk appetite and so on? Remember that independent financial advice is no longer accessible for most ordinary savers.

Osborne believes that people capable of building up decent savings can be trusted to manage them responsibly. The fraudsters who separate affluent, apparently sophisticated investors from their money with staggering ease will beg to differ. The correlation between wealth and financial capability is lower than we assume.

Advertisement

Hide AdAdvertisement

Hide AdOsborne’s Budget bribe will also drive up the cost of annuities, to the enormous detriment of the many people for whom they remain the best option. There’s a risk of a buy-to-let boom as liberated pensions cash fuels house price rises and freezes even more younger people out of the property market.

Inequality will deepen as those who can’t afford to choose are left even further behind and the young pay for the largesse of the baby-boomer generation.

Next year George Osborne may look back on the 2014 Budget as an election turning point. In time, however, it will become increasingly apparent that Osborne was guilty of an abdication of responsibility which could leave millions of people with nothing to show for a lifetime of saving.