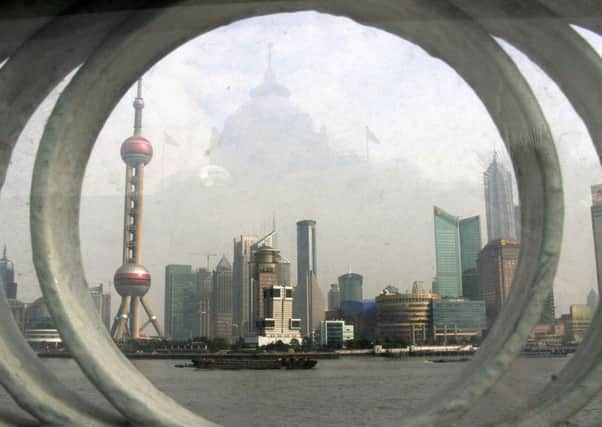

IMF slashes growth forecast on China slowdown

In its latest World Economic Outlook, the IMF predicted world growth of 3.1 per cent this year, down from its previous projection of 3.3 per cent.

The Washington-based fund said a combination of Chinese slowdown, sliding commodity prices and uncertainty over when the US hikes interest rates would lead the world to its lowest annual growth rate since 2009.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the IMF increased its forecast for UK growth this year by 0.1 percentage points to 2.5 per cent, and kept its expectation of 2.2 per cent growth for next year unchanged.

The latest forecast from the Office for Budget Responsibility for UK growth has slightly revised down the expectation for 2015 to 2.4 per cent from 2.5 per cent, due to lower-than-expected growth in the first quarter of the year.

But the IMF said this would still make the UK the second-fastest growing country in the G7 group of nation advanced nations in 2015 or 2016 – ahead of Germany, France, Italy, Japan and Canada.

Only the US of the G7 nations is forecast to have a faster growth rate at 2.6 per cent this year and 2.8 per cent in 2016.

The fund forecasts advanced economies will fare better over the next few years, because they are less exposed to falling commodity prices and a rise in US rates than developing nations.

It said China – the world’s second-largest economy – will grow by 6.8 per cent this year and 6.3 per cent next, which is below Beijing’s 7 per cent targeted growth rate.

The added that China is transforming away from export and manufacturing growth to a greater focus on consumption and services, and although this change will be healthy over the long term the move “has near-term implications for China’s growth and its relations with its trade partners”.

IMF economic counsellor Maurice Obstfeld said: “Six years after the world economy emerged from its broadest and deepest postwar recession, the holy grail of robust and synchronised global expansion remains elusive.

Advertisement

Hide AdAdvertisement

Hide Ad“Despite considerable differences in country-specific outlooks, the new forecasts mark down expected near-term growth marginally but nearly across the board. Moreover, downside risks to the world economy appear more pronounced that they did just a few months ago.”