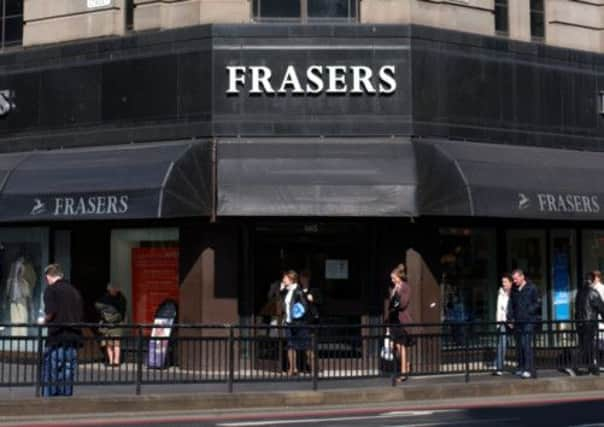

House of Fraser could float by spring

A flotation would cement a remarkable turnaround for House of Fraser, which was taken private by an Icelandic consortium seven years ago and which is now believed to think financial market conditions have improved sharply enough for a return.

The group – which opened its first store in Glasgow in 1849 and now has more than 60 sites in the UK and Ireland – is understood to have conducted a “beauty parade” of investment banks to advise on a potential listing.

Advertisement

Hide AdAdvertisement

Hide AdAn appointment is expected within weeks, with some sources suggesting it could float before the spring. Analysts have put a market valuation on HoF of between £300 million and £400m.

The group – which employs 7,300 people and generated underlying profits of £61.1m on sales of £1.2 billion last year – was taken private in a £350m buyout led by Iceland’s Baugur Group in 2006.

Don McCarthy, HoF’s chairman, owns 20 per cent of the company along with his family, with a further 49 per cent controlled by representatives of failed Icelandic banks, which took Baugur shares went it subsequently went bust.

Retail tycoon Sir Tom Hunter, founder of Sports Division, holds 11 per cent, and Kevin Stanford, another retail entrepreneur, has 10 per cent.

A company spokesman said at the weekend: “We have taken no decision [on a float] and are focusing on building a great global business”

It recently emerged that construction firm Miller Group is mulling a possible stock market listing, while Just‑Eat, an online takeaway operator, is understood to have also talked with financial advisers in recent weeks about a possible £300m flotation.

Just-Eat, set up in Denmark more than a decade ago but now based in London, posted a 76 per cent jump in turnover to £60m last year amid losses widening to £2.6m from £1.7m.

DFS, Britain’s biggest sofa retailer, online property website Zoopla and Merlin Entertainments, the owner of Madame Tussauds, are among a flurry of firms planning to access the stock market. Shares in Royal Mail are due to begin conditional trading on Friday.

Advertisement

Hide AdAdvertisement

Hide AdIn another sign of the revival in equity markets, the UK government recently sold down part of the taxpayers’ holding in Lloyds to capitalise on growing investor appetite, while Royal Bank of Scotland further reduced its stake in its spun-off Direct Line insurance operation.

Nick Parsons, market strategist with National Australia Bank, said: “I think this rush to the market is partly because reasonable investors believe the economic recovery is finally becoming established.

“There is also the impact of the Bank of England’s quantitative easing. It has depressed yields and effectively forced savers and investors into riskier instruments, and that includes IPOs.”

Parsons said there was also an “opportunistic” element of owners of private businesses wanting to exploit better stock market conditions to “cash out a little bit” of their holdings.

“Some owners might think, ‘We have got through the risky phase economically. Even if we are still in for the long-term, why not take out £150m or £200m?’”