Glasgow start-up to disrupt first-time buyers market with major funding boost

Glasgow-based Nude was formed to “stand up for first-time buyers” with its founders branding the current system unfair.

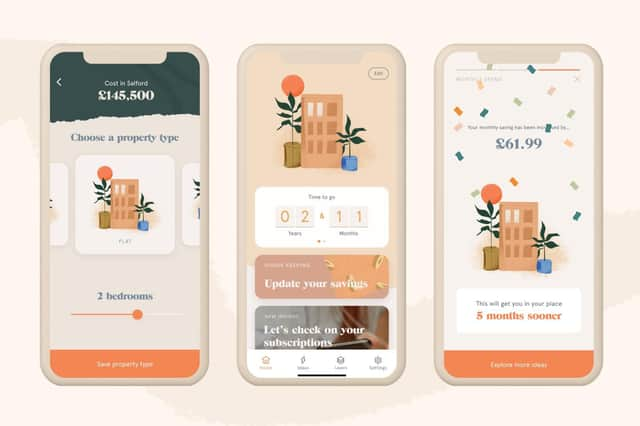

The savings account, financial coach and app has been designed to help aspiring home-owners better understand their finances and the home-buying process, Nude said.

Advertisement

Hide AdAdvertisement

Hide AdThe fledgling financial technology business has raised £3.4m, following the launch of a funding campaign via the Seedrs crowdfunding platform.

Since going live on 6 July, the firm has surpassed 97 per cent of its £3.5m target, much of which was secured before the campaign was fully launched to the public.

Crawford Taylor, chief executive and co-founder of Nude, said: “The challenges facing young people are huge, with a massive wealth imbalance, a complex financial system and little help.

“We’ve been planning, testing and building Nude to make the financial world fairer and easier, starting with helping people buy their first home faster and easier than ever before.”

The founding team comprises Taylor, previously a partner of actuarial firm Hymans Robertson; chief marketing officer Marty Bell, co-founder of Tens sunglasses and founder of viral website Poolside FM; head of legal Kate McKay, an ex-partner at an angel investor syndicate; and chief operating officer Stephen Doherty, previously chief technology officer of Hymans Robertson and chief product owner at RBS.

Co-founder Bell said: “We don’t think the financial world is very friendly, or easy, and it definitely doesn’t make you feel as good as you should when you’re managing to save up a house deposit – we’re here to change that. Nude is like having a friend that’s really good with money with you, all the time.”

Leah Pape, head of scaling services at Scottish Enterprise, added: “Nude has a really interesting and innovative product that we were pleased to support in its early stages.

“Its app is needed more now than ever, at a time when many young people are having to manage their finances closely in order to get that first footing on the property ladder.

Advertisement

Hide AdAdvertisement

Hide Ad“We’re excited to explore how we can continue our support of Nude as it grows in popularity and expands its product range.”

Last year, the business raised £1.7m in growth capital and was the recipient of a £440,000 Smart Scotland innovation grant from development agency Scottish Enterprise. Investors in this funding round include the UK government’s Future Fund.

The start-up also plans to apply for a banking licence to launch mortgage products.

Pointing to a range of research, Nude said that is was estimated that some 13 million 18-35 year olds in the UK want to own their home.

A message from the Editor:

Thank you for reading this story on our website. While I have your attention, I also have an important request to make of you.

The dramatic events of 2020 are having a major impact on many of our advertisers - and consequently the revenue we receive. We are now more reliant than ever on you taking out a digital subscription to support our journalism.

Subscribe to scotsman.com and enjoy unlimited access to Scottish news and information online and on our app. Visit https://www.scotsman.com/subscriptions now to sign up.

By supporting us, we are able to support you in providing trusted, fact-checked content for this website.

Joy Yates

Editorial Director

Comments

Want to join the conversation? Please or to comment on this article.