Gareth Shaw: New version Isas may not match original

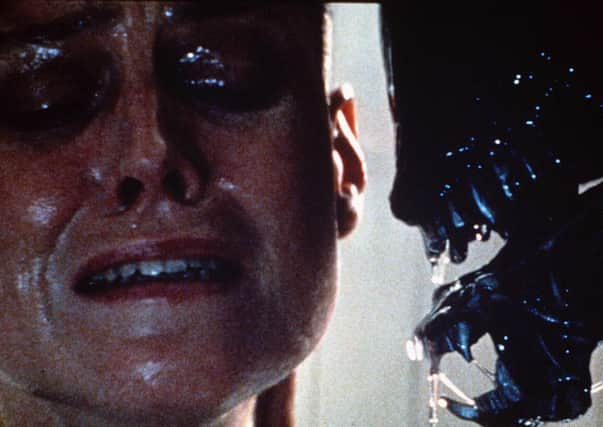

Of course, when you finish streaming a film online, you get served up the rest in the series to keep you trapped, binge-watching in your pyjamas. Up came Alien 2, James Cameron’s action-packed sequel, which ramped up the excitement factor with crowd-pleasing bluster. But then, the subsequent movies descended quickly into naffness – Alien 3, and Prometheus among them. A premise that was once hailed as a masterpiece was sequelised to near-death in Hollywood’s clamour for popularity and a quick buck.

Back in shirt and tie and in the working world, eagerly awaiting the new tax year, I’m beginning to worry that the nation’s favourite savings product, the Isa, is now at risk of having its own sequel problem. Next week sees the introduction of the Lifetime Isa: a new tax-free savings product designed to help people, aged between 18 and 40, save for either their first home or retirement.

Advertisement

Hide AdAdvertisement

Hide AdThis is just the latest permutation of the rapidly expanding Isa family. In recent years, we’ve seen Junior Isas, Help to Buy Isas, Inheritance Isas, Flexible Isas and Innovative Finance Isas all be launched with great fanfare, heralded as new tax-free ways to help Briton’s save for the future.

And don’t get me wrong – some rewrites to the Isa script have been hugely welcomed. The decision to remove the cash savings limits and add the ability to transfer back and forth between cash and stocks and shares were long overdue. The changes to the inheritance rules on Isa savings sensibly bring them in line with the tax-free transference of assets to spouses and civil partners. Savers and investors have cheered as the savings limits have near-doubled in the space of just a few years (although, I will share my concerns about this later on).

But, with increasing complexity being added to the Isa product range, could one bad sequel run the risk of eroding the trust that so many have in the Isa brand?

Last year, many young savers were reportedly caught out when they came to put their Help to Buy Isa savings towards buying their first home, only to find that the 25% government bonus could only be used on completion of sale and not on the exchange of contracts. There were reports of people scrabbling to find the shortfall or risk losing their dream home.

Innovative Finance Isas –which allow you to invest in start-ups and through peer-to-peer lenders tax-free - have also made a slow start. None of the mainstream, long-established peer-to-peer lenders have launched an Innovative Finance Isa yet. And, those that have, are perhaps at the riskier end of the spectrum. My concern here is not with the investment opportunities that these new finance companies are offering, but that some may be tempted towards products that may not be right for them, simply because they fall under the Isa banner.

That brings us to the latest Isa blockbuster, the Lifetime Isa. On paper, they look attractive enough - put in £4 and the government gives you a £1 bonus, to a maximum of £4,000 a year. Use them to either save for your first home, or keep investing throughout your life and when you hit 60, you can access your savings tax-free. Access your money before that age, and you face a penalty charge and the loss of your bonus.

But does the arrival of the Lifetime Isa – and indeed the increases to the overall Isa limit – signal a much bigger change to the benefits you get for saving into a pension? There’s no doubt that Isas are a popular savings option, but is it coming at the expense of people saving into their pension?

The Isa is now available in more guises than ever, so there’s more to think about when picking the right option for you:

Advertisement

Hide AdAdvertisement

Hide AdIf you’re not that happy taking risks then a cash Isa is probably the way to go.

If you’re happy to lock away your money for a few years, usually between one and five years, then it makes sense to consider fixed-rate Isas. Generally, the longer you tie up your money, the better the interest rate you will receive.

If you’re happy to take some risk then consider a stocks and shares Isa, which offer the possibility of higher returns but your investment could go down as well as up.

Finally, if you’re thinking about the long term then consider putting money in to a pension.

The great appeal of the Isa has always been its simplicity: take responsibility and save or invest for your future and be rewarded with tax-free growth and income. But, one major scandal with these increasingly complex additions to the Isa family could do irreparable damage to a much-loved financial product. And, no-one wants to see the Isa version of Alien vs Predator, do they?

Gareth Shaw is head of Which? Money Online