Five Scots retailers close a week in first half of year

The pace of retail closures across Scotland’s largest towns and cities has settled at approximately 5 per week over first six months of 2015, sparking fears that online shopping is pushing bricks-and-mortar shops into closure.

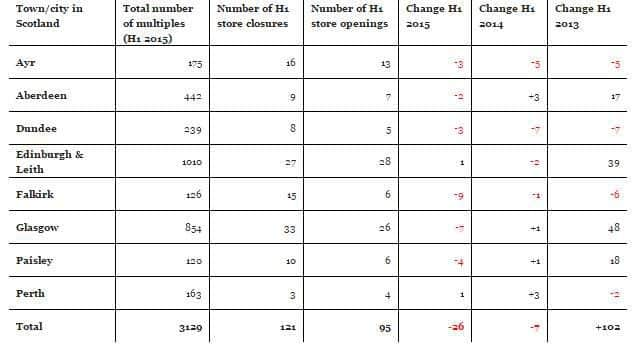

According to the PwC and The Local Data Company analysis, 121 stores owned by multiple retailers shut up shop, with only 95 opening their doors, giving a net reduction of 26 stores.

Advertisement

Hide AdAdvertisement

Hide AdDuring the same period in 2014, a total of 133 new stores opened; a move that helped to minimise the overall high street impact after 14o outlets pulled down the shutters.

Over the first half of 2015, only Perth and Edinburgh (including Leith) reflected a net increase with just one store. Even Edinburgh’s status as one of Scotland’s most-visited locations recorded a net loss of two stores, with Perth remaining stable with a net uplift of one store.

In contrast, the remaining locations reported a net reduction in outlets, with Falkirk (minus 9) and Glasgow (minus 7) reporting the biggest loss.

Northern micro-economy Aberdeen recorded an uplift year on year with a net loss of two stores compared to the first half of 2014.

While there have been fewer retailer insolvencies this year, resulting in a less hostile environment for multiple retailers, the ‘clicks over bricks’ battle continues to rage.

According to Martin Cowie, Head of Private Business for PwC in Scotland, store portfolios continue to be reviewed in response to the relentless advance of online shopping.

He said: “The digital revolution impacting our high streets shows no sign of abating; consumers continue to adopt newer digital channels, mobile technologies and smartphone apps as they become available while younger ‘digital natives’ are developing a different type of relationships with traditional outlets than previous generations.

“Landlords are also being hit by this tug of war between “clicks” and “bricks”. We’re also seeing major changes for landlords with the average unexpired length of a lease now less than nine years compared to 22 years back in the early 1990’s. The renewal rate on leases is down to 9 per cent in recent years, compared to 30 per cent in the mid 2000’s.

Advertisement

Hide AdAdvertisement

Hide Ad“As a result of this ongoing trend, multiple retailers are more likely to approach town centre openings very cautiously. This is likely to mean shorter-term leases and more temporary pop-up type formats, particularly during high footfall periods such as Christmas and major city centre festivals and in secondary locations.

“It’s becoming increasingly likely that the high streets of the future will be based around immediate consumption of food, goods and services or distress or convenience purchases. It might not be what many consumers want but the data and business economics are pointing in that direction at the moment.”