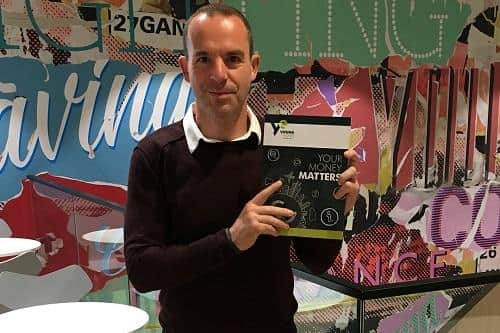

Financial education textbook backed by Martin Lewis sent to hundreds of Scots schools

Young Money and Young Enterprise Scotland have sent Your Money Matters to more than 350 high schools follows the launch of a digital version of the textbook, an accompanying online teacher’s guide, and a PowerPoint version for use in lessons, which were all made available for free in March to support home learning.

The textbook has been developed to support schools to deliver a holistic programme of financial education, providing more students with the essential knowledge, skills and attitudes towards money as they transition into greater independence.

Advertisement

Hide AdAdvertisement

Hide AdIt has been produced with support from Education Scotland, and thanks to personal funding from Mr Lewis, and the Money and Pensions Service. The Scotland edition builds on the 2018 rollout of the textbook in England, where 340,000 copies were delivered into schools.

The guide offers advice on, say, the importance of saving money, how to manage a budget, understanding payslips, student finance, and advice on how to avoid hazards such as fraud and identity theft, unmanageable debt, gambling, and being targeted as a money mule.

Mr Lewis said: “The pandemic has shown the lack of personal financial resilience and preparedness of the UK as a whole. Not all of that can be fixed by improving financial education, but a chunk of it can.

“I’m delighted that now we’ve proved the success of [this textbook] in England, the Money and Pensions Service has agreed to team up to provide this much-needed resource for Scotland – adding a rightful sense of officialdom to the whole project.”

Allison Barnes, Scotland manager at The Money and Pensions Service, said: “The textbook forms part of a £2 million UK-wide package by the Money and Pensions Service to support the delivery of meaningful financial education, including to 150,000 more children growing up in Scotland by 2030. This commitment is one of the ways we are supporting children and young people as part of our UK Strategy for Financial Wellbeing.”

A message from the Editor:

Thank you for reading this article. We're more reliant on your support than ever as the shift in consumer habits brought about by coronavirus impacts our advertisers.

If you haven't already, please consider supporting our trusted, fact-checked journalism by taking out a digital subscription.

Comments

Want to join the conversation? Please or to comment on this article.