Binance UK: HSBC joins Barclays and Clear Junction in stopping payments to Binance as crackdown on cryptocurrency exchange continues

UK customers of what has been called the world’s largest crypto exchange are still unable to make ‘fiat’ withdrawals in GBP from their Binance accounts after payment provider Clear Junction announced it would no longer be supporting GBP and EUR payments to Binance in mid July.

There have now been further waves of action against the company as British multinational bank HSBC told customers on Monday August 2 that it would no longer be supporting credit card payments to Binance.

Advertisement

Hide AdAdvertisement

Hide AdThe new comes after the Financial Conduct Authority (FCA), the UK’s highest financial auditing authority, issued a consumer warning on June 26 about cryptocurrency exchange platform Binance, saying that UK operations arm Binance Markets Limited “is not permitted to undertake any regulated activity in the UK”.

Since the FCA issued the warning over the safety and security of cryptocurrency exchange platform Binance, the company has been under greater scrutiny from customers, regulators and banks alike.

It has become part of a wave of international action from state authorities across the globe who have grown alarmed by crypto’s rapid rise and centrality to emerging avenues for money laundering and organised crime.

On June 21 the Chinese Government declared that it would be clamping down on the considerable amount of cryptocurrency mining taking place in the country, with the impact of the announcement seeing Bitcoin, Dogecoin and Ethereum prices tumbling.

South Korea, another crypto hotspot, recently seized the cryptoassets of around 12,000 citizens accused of tax evasion totalling over $47 million in value, while the Metropolitan Police made the UK’s largest cryptocurrency seizure yet in a crackdown on laundering seizing an estimated £180 million worth of cryptocurrency.

Here’s everything you need to know about what this latest action against Binance means.

What is Binance?

Binance is a cryptocurrency exchange platform which is used worldwide by people looking to trade cryptocurrencies like Bitcoin, Ethereum and more, with its website offering a centralised platform through which to participate in decentralised monetary exchange by buying, selling or getting loans secured by cryptoassets.

Based primarily in the Cayman Islands, Binance Group has an assortment of entities worldwide which include London-based Binance Markets Limited.

Advertisement

Hide AdAdvertisement

Hide AdDespite being recently awarded a Letter of Commendation sent by the UK South East Regional Organised Crime Unit for “[their] cooperation in assisting our investigations relating to the Supply of Class A Controlled Drugs via the Dark Web”, Binance has now become a greater subject of scrutiny by regulators in the UK.

Did the FCA ban Binance?

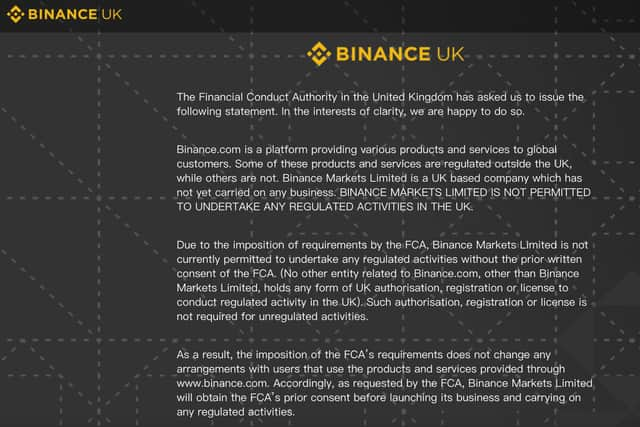

The FCA said in their statement that Binance Markets Limited, a subsidiary of the larger Binance Group corporation, "is not permitted to undertake any regulated activity in the UK” and under FCA requirements cannot attempt to do so “without the prior written consent of the FCA”.

This decision from the financial authority comes after plans for a new regulated ‘Binance UK’ affiliate company and crypto exchange based in the UK failed to materialise.

In addition to this, the FCA issued a consumer warning over Binance Group and the services offered on its website, Binance.com, to UK users – informing them of the risks of using Binance.com and investing in decentralised cryptocurrency or cryptoassets which are not regulated by traditional state or monetary authorities.

“No other entity in the Binance Group holds any form of UK authorisation, registration or licence to conduct regulated activity in the UK,” the FCA added.

“The Binance Group appear to be offering UK customers a range of products and services via a website, Binance.com.”

Describing itself as ‘the world's largest crypto exchange’, Binance and similar exchanges must be registered with the FCA in order to operate fully and promote their services in the UK.

And while cryptocurrencies like Bitcoin and Ethereum are unregulated, some cryptoasset derivatives like futures contracts and contracts for difference - allowing traders to bet on the future price movements of crypto rather than buy actual cryptocurrencies – are regulated by the FCA.

Advertisement

Hide AdAdvertisement

Hide AdBinance tweeted in response to say that the FCA’s notice “has no direct impact on the services” it provides on its exchange platform.

"BML is a separate legal entity and does not offer any products or services via the http://Binance.com website.

"The Binance Group acquired BML May 2020 and has not yet launched its UK business or used its FCA regulatory permissions."

The FCA’s consumer warning and clampdown is not totally unsurprising, however.

Similar statements to the FCA’s regarding Binance services and operations were issued in Japan and the Cayman Islands where Binance is primarily based.

It was recently revealed by Bloomberg that the huge crypto exchange’s company, Binance Holdings Ltd, is under investigation by multiple US federal departments, including the US Justice Department, the Internal Revenue Service and the Commodity Futures Trading Commission, for potential criminal activity.

Thailand’s Securities and Exchange Commission filed a criminal complaint against Binance on Friday July 2, for operating certain cryptoasset services without a license after Binance failed to provide written correspondence in response to the body’s initial warning in April.

Why have HSBC, Barclays and Clear Junction stopped payments to Binance?

In an email sent to UK users who had made previous credit card payments to the crypto exchange, HSBC said: “We wanted to let you know we're stopping payments from our credit cards to Binance wherever possible.

Advertisement

Hide AdAdvertisement

Hide Ad"We've made this decision due to concerns about the possible risks to you.

"We take our duty as a responsible lender seriously and want to do everything we can to protect you will continue to monitor the situation and let you know if anything changes.”

Much like the similar statements issued by Barclays and Clear Junction last month, HSBC went on to cite the FCA notice and warning over Binance’s activity – pointing users to the FCA’s statement to find out more.

HSBC has been approached for comment.

Clear Junction issued a statement on (July 12) announcing their decision to stop processing transactions to Binance and, like Barclays before it, directly referenced the FCA’s announcement in late June.

They said: “Clear Junction can confirm that it will no longer be facilitating payments related to Binance.

"The decision has been made following the Financial Conduct Authority’s recent announcement that Binance is not permitted to undertake any regulatory activity in the UK.

“We have decided to suspend both GBP and EUR payments and will no longer be facilitating deposits or withdrawals in favour of or on behalf of the crypto trading platform.

"Clear Junction acts in full compliance with FCA regulations and guidance in regards to handling payments of Binance.”

Advertisement

Hide AdAdvertisement

Hide AdOn July 5, Barclays bank informed UK customers who had previously made payments to Binance that it had blocked payments to the platform until further notice, telling customers that this was done “to help you keep your money safe”.

A Barclays spokesperson said: “With effect from today, Barclays intends to stop credit and debit card payments to Binance.

"This action does not impact on the ability for customers to withdraw funds from Binance.

“The decision has been taken following the FCA warning to consumers, to help keep our customers’ money safe."

In response, Binance took to Twitter and responded to what it called a “disappointing” move from partners like Barclays, saying it was “based on what appears to be an inaccurate understanding of events”.

They added: “We take our compliance obligations very seriously, and we are committed to working collaboratively with regulators to shape policies that protect consumers, encourage innovation, and advance the industry.”

How have Binance’s UK customers been affected?

UK customers using Binance services will still be able to use the platform but still do not have access to Faster Payment channel withdrawals allowing them to access their cryptocurrency as British pound sterling.

In their email to users on July 13 after the latest suspension on GBP withdrawals occurred, Binance said: "Please note that GBP bank withdrawals (via Faster Payments) are temporarily suspended.

“We are working to resolve this issue as soon as we can.

Advertisement

Hide AdAdvertisement

Hide Ad"In the meantime, users are still able to buy cryptocurrencies with GBP via Credit/Debit cards on Binance.”

The company went on to apologise for any inconvenience and thank users for their patience.

On June 28, UK-based users began reporting that following the confusion over Binance’s future in the UK, they were unable to make Faster Payment deposits or withdrawals with GBP from their Binance accounts.

Those logging into their account and preparing to make withdrawals were confronted with a notice that the payment channel allowing UK users to make fast withdrawals from their accounts in GBP sterling was ‘under maintenance’.

The FCA’s warning urged British consumers to take care and be aware of the greater risks when investing in cryptocurrency and cryptoassets which are unregulated in the UK.

The FCA does, however, have a deadline of March 31 2022 which crypto asset businesses must meet and register by in order to continue trading in the UK.

The ban on Binance Markets Limited has also forced the UK-based company to cease any advertising and promotions by June 30.

Binance has now displayed a notice on its UK website as per the requirements of the FCA statement.

Advertisement

Hide AdAdvertisement

Hide AdKey to FCA concerns around cryptocurrency operations is the rise of scams taking place through social media platforms, where users are often approached out of the blue for investment opportunities in coins like Bitcoin, Dogecoin and Ethereum.

According to the FCA, those using such platforms and trading in crypto “should do further research on the product you are considering and the firm you are considering investing with.”

A message from the Editor:

Thank you for reading this article. We're more reliant on your support than ever as the shift in consumer habits brought about by coronavirus impacts our advertisers.

If you haven't already, please consider supporting our trusted, fact-checked journalism by taking out a digital subscription.

Comments

Want to join the conversation? Please or to comment on this article.