Listen in and discover the four corners of Johnnie Walker

The story starts with the grocery store, bought for just over £500 and opened in 1820. In it, John Walker sourced spirits such as gin, brandy, rum and Scotch, as well as more exotic products, including tea from China and pepper from Jamaica.

Having learned of the art of blending tea, John transferred the technique to whisky in an attempt to make a more consistent product from single malts, which could often fluctuate in quality in those days.

At first, he did this for his favoured customers on request, but eventually he would make regular batches for regular buyers, settling on smoother recipes that balanced out the impurities of the single malts of the time, and this would form the basis of the blended whisky category we enjoy nowadays.

Whiskies that went into the Johnnie Walker blend we know today were sourced by John’s son, Alexander, and include Cardhu from Moray; Clynelish, from near Brora in Sutherland; Caol Ila, from the isle of Islay; and Glenkinchie in Tranent, East Lothian – known as the four corners.

In our latest partner episode of Scran, we find out more about the distilleries that form the four corners, and what they bring to the famous Johnnie Walker blend.

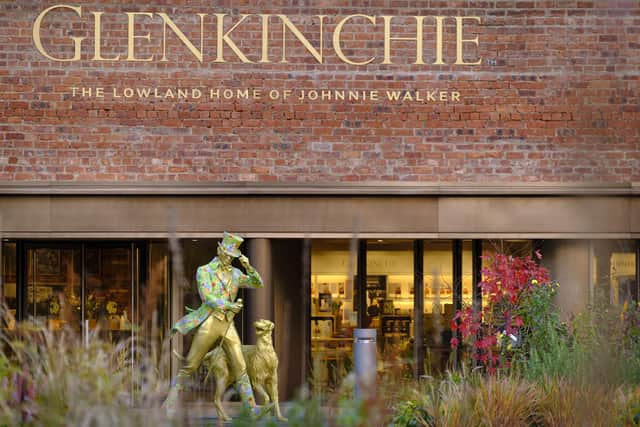

First stop on the podcast’s whisky trail is Glenkinchie Distillery, the lowland home of Johnnie Walker. We tour the distillery to find out about its history, processes, characteristics and so much more, including the impact of the owner’s ongoing £185 million investment into Scotch whisky tourism.

Glenkinchie was the first of the four corner distilleries to form a network of whisky visitor experiences linked to the Johnnie Walker Princes Street attraction in Edinburgh, all of which have been completely transformed by the investment.

While at Glenkinchie, we met with Ervin Trykowski, global ambassador for owner Diageo, who filled us in on all the exciting changes at each of the four corners visitor experiences.

A highlight of the Glenkinchie Distillery is its abundant garden area with an orchard and specially selected plants native to the East Lothian region. These are planted to create year-round seasonal variations, which showcase the light and floral nature of the whisky produced.

Throughout the episode, we speak to representatives from Johnnie Walker’s other three corner distilleries, namely Hazel Urquart, assistant experience, events and retail manager at Clynelish; Joanne Henderson, assistant experience and events manager for Cardhu; and Kirsty Basnett, assistant manager experience and events for Caol Ila.

Download the podcast to hear about the Moray distillery’s history and how two powerful women – Cardhu’s founder Helen Cumming and her daughter-in-law, Elizabeth – took on running the place as it grew into a successful business during the 19th Century until it became the first distillery to be acquired by John Walker & Sons in 1893.

At Caol Ila, Kirsty explains what visitors can expect at the Islay facility and about her favourite parts of the new-look distillery and tour, while in Clynelish we discover the history and ties with Brora, an iconic ghost distillery which reopened last year.

To listen to the podcast, use this QR code, or go online to foodanddrink.scotsman.com/podcasts/bonus-scran-exploring-the-world-of-johnnie-walkers-four-corners