Chinese cash could fund Scottish construction

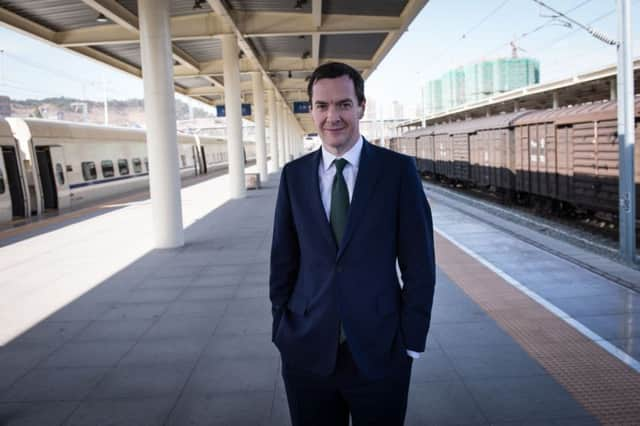

Chancellor George Osborne this week travelled to China to try and attract investors there to bid for seven contracts worth £11.8 billion in total covering the first phase of HS2, between London and Birmingham.

Michael Watson, an infrastructure and projects lawyer at Pinsent Masons, said the visit could also have a knock-on impact north of the Border but only if Scotland is able to present an attractive investment proposition for the Chinese.

Advertisement

Hide AdAdvertisement

Hide AdHe said success in getting the cash-rich Chinese to support energy, transport and manufacturing projects, depended on offering up schemes which are large enough in scale and which are at an advanced planning stage.

“The Chinese tend to look for fairly substantial transactions to invest in, so they can deploy significant amounts of capital and create openings for their supply chain, technology and manpower to help build these assets,” said Watson.

The law firm recently produced a report – “China Invests West” – which claimed that over the next decade China could invest £105 billion into UK infrastructure with the energy sector the biggest target.

“There is no reason why Scotland should not get its fair share,” noted Watson. “Indeed the current turmoil in the domestic Chinese markets create further opportunities for Scotland and the UK – where Chinese investors can turn to, seeking more stable and predictable returns in infrastructure investments.”

Watson said he was upbeat about the combined efforts of the Scottish Government, Scottish Futures Trust and Transport Scotland to attract overseas investors in large infrastructure projects.

“There has been a concerted effort from Scotland to attract investment from China and this could be a game-changer for Scottish infrastructure, but only if we can provide suitable projects of the scale and appropriate level of readiness which would appeal to investors.

“In order to do that we have to have ‘investable’ projects and that means taking these schemes to a stage of development where planning, structure and consent is in place. The key is to have projects which are visible, well developed and ready to be invested in, because we are competing in an extremely competitive global market and the Chinese and other overseas investors have a wealth of options on where to put their money.”

Watson said projects of sufficient scale which could interest Chinese investors include the A9 Perth to Inverness dualling project and rail electrification programmes.

Advertisement

Hide AdAdvertisement

Hide AdIn the energy sector, updating ageing North Sea infrastructure and onshore and offshore power transmission and generation initiatives are other billion pound projects which may appeal.

“Scotland has a stable regulatory and political environment compared to most countries and relative to other parts of the UK it has had a more positive story to tell regarding infrastructure investment,” added Watson.

Earlier this year it was revealed that Scotland is becoming a hotspot for Chinese property investors looking for an alternative to London with Edinburgh in particular attracting interest.