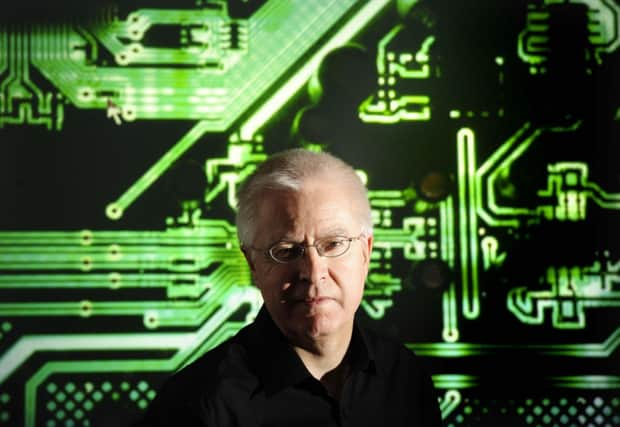

Business interview: Gordon Stuart

Stuart, 58, lists Rio Tinto and Schindler among the companies on his CV in a career that has been spent almost entirely in the technology world, some of it underground. He worked in a zinc mine in Australia, handling radio equipment. It was, he says, an eye-opening experience.

“There was a whole new world down there. It was like something out of a James Bond set,” he says with a sort of boyish sense of adventure. Rio Tinto offered him an opportunity to build a career Down Under but there was something else on his mind.

Advertisement

Hide AdAdvertisement

Hide Ad“My girlfriend was back in Scotland and I came home for her,” he says. It proved to be a good decision, as they’re still together 40 years later and now he is a doting grandfather.

He has also built himself a reputation in his homeland as one of the country’s technology specialists. Stuart heads up Informatics Ventures, an Edinburgh-based mentoring organisation that works with fledgling tech entrepreneurs, helping them become “investor-ready” in order to raise finance. They are coached in what investors are looking for, and how to present themselves. Among the trainers is a Silicon Valley veteran and an opera singer who works on voice and speaking techniques.

Today Stuart will unveil the list of those who have successfully applied to participate in the next investor conference in May. Of 130 applicants, 60 will exhibit, and of those 16 will be selected to give a ten-minute pitch to an audience of international business angels and institutions keen to back the next big thing. EIE14 (Engage, Invest, Exploit) takes place at the Assembly Rooms.

Last year’s event proved particularly popular after it was decided to broaden the remit from strictly IT companies to embrace the wider technology sector, including life sciences.

“I believe that gave us lift-off. We were not sure if it was what people wanted, but we became more attractive. The place was mobbed,” he says. A smaller event followed in London, an attempt to appeal to more London-based investors and to present Scottish start-ups to a different audience.

“What EIE gives investors is one day to see and hear from a cross-section of the best young technology companies in Scotland,” Stuart says.

He hopes the next event will see the number of investors rise from 140 last year to 200, and that it may also encourage more venture capital companies to set up in Scotland.

“We have a fantastic angel community, but there are only a handful of investment companies beyond that. We need more,” he says.

Advertisement

Hide AdAdvertisement

Hide AdStuart was a participant in one of the earlier EIE events and was asked if he would take on the role of senior executive of Informatics. Initially he turned down the offer, but later accepted. He is part-time, giving him an opportunity to continue his own personal mentoring of young firms. In the past decade he has been involved with 25 companies.

“There is an element of altruism in it but I like to think I can make a difference,” he says.

His spell in Australia was not the first time he had been tempted by a life overseas. He and the family sold everything they had in the late 1980s and headed to Switzerland where he worked for Schindler – only to be drawn back to Scotland for a second time after five years away.

In 1996, he and a few colleagues bought out the company’s research and development unit in Livingston, launching Spektra as a software company serving big financial services organisations. In 2001, Spektra was Scotland’s fastest-growing tech company. That same year, he and his three co-founders, who had injected £20,000 in seed funding, received a $20 million (£12m today) offer for their firm. The decision to turn that offer down still haunts him. Three years later the company was struggling and was wound up.

“At the time were so gung-ho and really flying. We thought we could take it to a $100m business and there was no reason to stop. We were doing very well and making good money. What we didn’t see was the economic downturn at the time. We just didn’t anticipate it.”

That downturn in 2003 saw many of the firm’s clients stop spending. Orders dried up, others were severely cut back.

“We thought we could trade through it, but it wasn’t to be. It was a controlled run-down. We sold the intellectual property and took some money out of the business.”

He admits that greed may have played a part, but it was also a case of enjoying the ride and not wanting to stop.

Advertisement

Hide AdAdvertisement

Hide Ad“Greed may be a bit harsh, maybe we were just over-ambitious,” he says, smiling when asked if he considered this to be a failure.

“We don’t as a nation handle failure well because it has a stigma. I prefer to say that failures are just people who have not been successful on that occasion. It is part of the learning process. Some people fear failure, but if you don’t have a go, you have no chance of success.”

30-second CV

Job: Senior executive, Informatics Ventures.

Born: Kirkcaldy, 1955, brought up in Duns.

Education: Heriot Watt University.

First job: Trainee engineer, Rio Tinto, Broken Hill, New South Wales.

Ambition while at school: To see the world.

Kindle or book? Kindle.

Music: Proclaimers.

Can’t live without: Mrs Stuart.

Favourite place: Holetown, Barbados.

What makes you angry? Rudeness.

Best thing about your job: The Informatics team.

Hobbies: Skiing and snowboarding.

Favourite film: Butch Cassidy and the Sundance Kid.