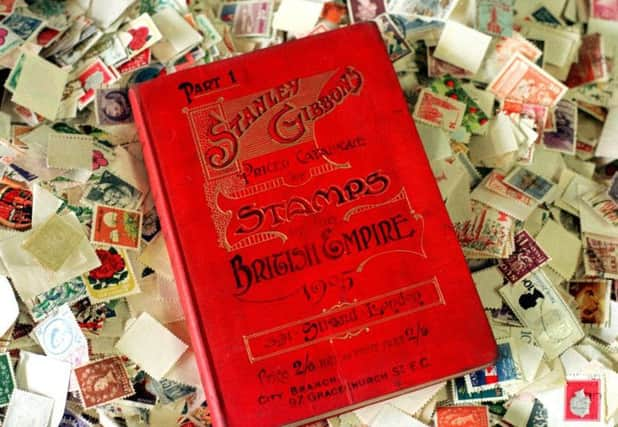

Bank support key for stamp firm as annual losses widen

Pre-tax losses in the year to March rose from £27.9 million to £30.2m and revenues also fell sharply from £59.1m to £42.5m as the company confirmed that it was in default on its loans.

The group has been stung by a slowdown in the stamps and collectables market and hampered by a string of failed historical acquisitions.

Advertisement

Hide AdAdvertisement

Hide AdIt is now trying to dump non-core assets in an effort to raise cash, and yesterday announced it had agreed to sell part of its interiors division in a deal worth up to £1.7m.

Stanley Gibbons chairman Harry Wilson said: “There can be no guarantee that the bank will provide facilities beyond 31 May 2018 and the company is likely to require access to further liquidity in the intervening period.

“The company remains in constructive discussions with the bank, regarding its short-term liquidity requirements, and the terms of such funding in such form as it may become available.”

However, he added that the board had “reasonable grounds” to believe that funding will be available via further asset disposals or from an “alternative finance provider” should lenders pull the plug.

Despite its own financial woes, the company said the market for rare collectables had remained “surprisingly robust” despite political and market uncertainty.

“The higher quality items continue to be sought after and steadily increase in value over the medium to long term. The key to identifying such items is having specialists who know the difference – we are fortunate at Stanley Gibbons to have a number of such specialists,” Wilson added.

“The restructuring undertaken to date has put the group in a position where it is hoped its fortunes and reputation can be restored.”

The company’s disposal of part of its interiors division will see Gurr Johns Ltd pay £1.25m in cash plus an additional sum payable over the next 24 months.

Advertisement

Hide AdAdvertisement

Hide AdIn August the £2.4m sale of its entire interiors division to Millicent Holdings fell through. Stanley Gibbons is seeking to recover a termination fee from Millicent.

Earlier this year, Stanley Gibbons put itself up for sale as part of a review being led by finnCap, with private equity firm Disruptive Capital said to be among potential interested parties.