The Devil on Trial: Netflix documentary delves into Arne Cheyenne Johnson and true crime case which inspired The Conjuring

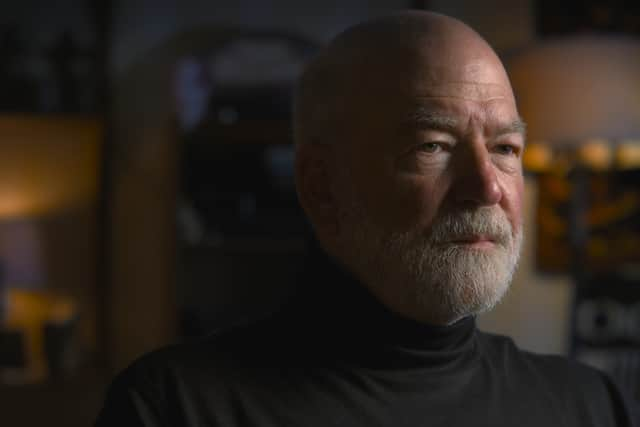

Often referred to as the 'Devil Made Me Do It' case, the trial of 19-year-old Arne Cheyenne Johnson was the inspiration behind the 2021 Conjuring film and Netflix’s new documentary The Devil on Trial.

It remains, to this day, the first and only US court case where “demonic possession” was used as a defence in a murder trial.

Advertisement

Hide AdComplicated by the involvement of the likes of Ed and Lorraine Warren – the exorcists at the centre of The Conjuring film series – this case quickly became notorious, particularly for its unprecedented legal strategy.

Here’s what you need to know about the true story behind The Devil on Trial.

What happened in the 'Devil Made Me Do It' case?

In 1981, 19-year-old Arne Cheyenne Johnson was charged with the murder of his landlord Alan Bono.

The police saw this as a straightforward event: a passion killing where tempers bubbled over with tragic consequences. However, according to Johnson and his family, the case was anything but.

They claimed that Johnson couldn’t be responsible for the death of Bono because there were supernatural forces at play – specifically demons.

It began with 8-year-old David Glatzel, the younger brother of Debbie Glatzel, Johnson’s then girlfriend and now wife.

Advertisement

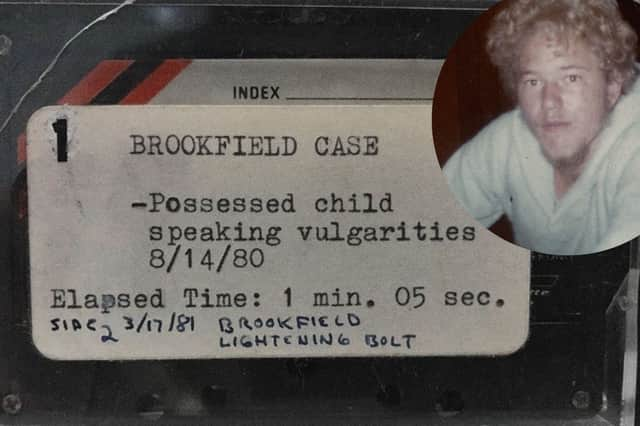

Hide AdDavid is said to have hosted a demon, with a series of strange occurrences happening to the young boy leading the family to enlist the help of paranormal investigators Ed and Lorraine Warren in a last ditch attempt to help the child.

The Warrens and Glatzels petitioned the Catholic church to perform an exorcism on David, though there are no reports of authorised exorcisms having taken place, at the end of the process an entity apparently fled from the young boy’s body, with Johnson supposedly accepting the spirit into himself to spare David.

Advertisement

Hide AdMonths later, Johnson stabbed Bono repeatedly with a 13cm pocket knife.

The incident took place during a gathering between a group of friends who had been heavily drinking, however Bono and Johnson both became agitated before Bono’s death.

Johnson was picked up around two miles away from the site of the murder covered in blood, and the day following the killing Lorraine Warren informed the police that he had been possessed during the crime.

Ed and Lorraine Warren and Arne Johnson

At the time of the case, Ed and Lorraine Warren were best known for their involvement in the Amityville Horror case.

In 1974, Ronald DeFeo Jr. shot and killed six members of his family at their home in Amityville, New York. He was convicted of second-degree murder in November 1975 and died in prison in March 2021.

However, one year after the murders George and Kathy Lutz and their three children moved into the house. After living there for a month the family fled the home, claiming to have been terrorised by paranormal entities while there.

Advertisement

Hide AdThe Johnson case took place six years following this, with the Warrens key to Johnson’s plea of not guilty by reason of “demonic possession” in court for the murder of Bono.

Lorraine was a clairvoyant, and while there had been no formal exorcism of David Glatzel during, Ed – a self-proclaimed demonologist – offered to perform a rite of his own to aid the child, leading to Johnson accepting the spirit into himself.

Advertisement

Hide AdAccording to the Warrens’ version of events, David had been inhabited not by a ghost but by a darker, demonic entity. Judy Glatzel, his mother, had reached out to the couple – after seeing a lecture of theirs – convinced something supernatural was taking place.

Later, following the Warrens’ exorcism attempts, Debbie Glatzel shared that she had seen Johnson show signs of possession multiple times before the night of the murder.

It was following Bono’s death that the Warrens’ began to share that Johnson couldn’t have been responsible as he had been possessed by a demonic entity.

Where is Arne Cheyenne Johnson now?

While initially set on using 'demonic possession' within his defence, Judge Robert Callahan refused the tactic. Instead Johnson’s defence attorney Martin Minnella argued self-defence.

Johnson was found guilty of first degree manslaughter on November 24, 1981, receiving a sentence of 10 to 20 years, of which he served 5, before being released for good behaviour.

Johnson was involved with the Netflix documentary though not much is known about his life outside of the case, however, in 1986 Lorraine Warren said he was “ready to work for a landscaper in town and he's coming home to live in a very good family atmosphere”.

Are Arne Johnson and Debbie Glatzel still married?

Advertisement

Hide AdJohnson married Debbie Glatzel while he was in prison in January 1984, however Glatzel is said to have died shortly before the release of The Conjuring: The Devil Made Me Do It in 2021.

The couple kept their private life quiet, though it is said that they had children.

Where to watch The Devil on Trial

The Devil on Trial is available to watch on Netflix.

Comments

Want to join the conversation? Please or to comment on this article.