Ronald MacDonald: The currency question

In my paper published today, I review the critical issues concerning the currency choice for an independent Scotland.

My perspective on this issue is taken from the economic literature on the costs and benefits of fixed versus floating exchange rates and I ask the question: if Scotland were independent what should its exchange rate regime look like? Would it look like the sterling zone regime that the Scottish Government is currently running with, or would it look different? In this regard, it is critically important to recognize that if Scotland were to become independent it would be a net exporter of hydrocarbons and this would have crucial and important implications for Scotland’s exchange rate regime.

Advertisement

Hide AdAdvertisement

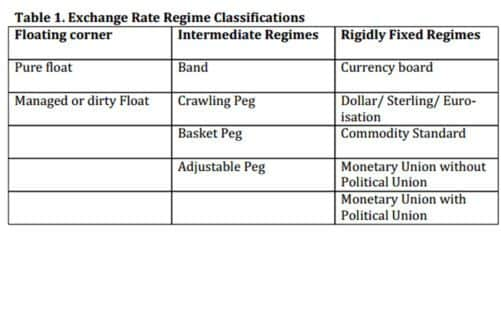

Hide AdConventionally there are two polar extremes referred to in the exchange rate literature of an irrevocably fixed exchange rate and a pure float. The former is where a country enters a political union with another country and its currency is subsumed into the monetary union of the wider union, while the latter case is that of a country with an independent currency, the external value of which is purely determined by market forces. In practice there are a number of shades of grey between these extremes and the IMF has usefully fleshed out the rich variety of intermediate cases, and these are noted in Table 1. The table shows that there are in fact 9 intermediate cases between the two extreme corners of a pure float and participation in a full blown monetary union, each of which can have numerous further variants.

The two polar cases are in the top left and bottom right cells. In between these corner cases there are a range of options distinguished by the degree of exchange rate flexibility, such as a managed float, a crawling peg system in which the peg changes, usually to accommodate inflation, and an adjustable peg in which the currency has a fixed central rate but it can be changed in crisis periods.

It is important to note that of the options given in the rigidly fixed column

it is only the corner solution that represents an irrevocable outcome for the exchange rate; in all other cases a sovereign country could renege or leave its commitment to the rate (for example, the Irish Republic’s experience with a currency board was not irrevocable). Herein lies an important problem for those proposing a fixed exchange rate for Scotland without a political union: economic history suggests that for a fixed exchange rate system to be effective and credible it must offer an adjustment mechanism to the participating country.

For example, the so-called gold standard in which countries pegged their currencies to the price of gold (the Commodity Standard cell in table 1) is often taken as an example of a fixed exchange rate par excellence, but it was nonetheless a highly credible system. Why? My colleague, Michael Bordo, and I have demonstrated (Credibility and the International Monetary Regime, CUP, 2012) that the gold standard represented a highly credible exchange rate regime because it offered a country a realistic adjustment mechanism, in the form of an escape clause: in times of crisis a currency could suspend its participation in the gold standard for a limited period of time as long as it was committed to returning at the previous parity. Furthermore, the existence of so-called gold points imparted enough flexibility into the operation of the gold standard to allow participating countries some flexibility in the operation of their monetary policy on a day-to-day basis.

However, the fixed exchange rate proposed by the Scottish government offers no such adjustment and therefore cannot be a credible option. Why? Much has been made in the recent debate about whether Scotland forms an optimum currency area with RUK and both sides in the debate have used criteria such as labour/ capital mobility and the close trade links between Scotland and RUK as indicators that the UK is an optimum currency area (OCA). However, the recent

OCA literature focuses on a so-called shock absorber approach that examines the kind of shocks hitting economies, in terms of whether they are common or asymmetric; and if common whether or not they have asymmetric effects on output and employment.

If Scotland were to become an independent nation it would be a net exporter of hydrocarbons whereas its near neighbour, RUK, would remain a net importer of oil. Hence if there are shocks to the price of oil, which there are bound to be, these would be classified as asymmetric shocks between the two areas. Furthermore, common shocks are likely to have an asymmetrical effect on output and employment in Scotland relative to RUK since the industrial structures of the two areas is not the same. By failing to recognize these crucial issues, the Scottish Government’s exchange rate proposal cannot be a long run solution to the needs of an independent Scotland. And since it cannot be a longterm solution neither can it be a short-term solution since expectations exert such a powerful influence over exchange rates and other asset prices that the long term becomes the short term very rapidly indeed.

Advertisement

Hide AdAdvertisement

Hide AdTo avoid the potentially unpleasant consequences on employment andoutput of asymmetric and common shocks Scotland would need an independent currency and this currency would need to have some flexibility to absorb the shocks likely to buffet the Scottish economy. This could take the form of

a managed float, much as in the recent Norwegian case, and could involve a basket of currencies determined by trade shares. Only exchange rate choices that recognise the diversified trading nature of the Scottish economy and the importance of the hydrocarbon sector are going to be seen to be credible by financial markets and offer Scottish policy makers the adjustment mechanism they will clearly need in an independent country. History clearly demonstrates that fixed exchange rates that are not tied down by a political union and do not offer a country an appropriate adjustment mechanism will only survive if the country is prepared to accept prolonged economic disruption, as we clearly observe in the euro area today.

About Ronald MacDonald

Ronald MacDonald is one of the worlds leading experts on exchange rate issues.

He has been a consultant to the IMF on 14 separate occasions on exchange rate related issues. In February 2012 he was appointed a monetary advisor to the IMF. He has also advised numerous central banks on exchange rate issues, including the European Central Bank, the Reserve Bank of New Zealand and the Monetary Authority of Singapore, and also certain Gulf State Countries and the European Commission. He has published widely on the topic of exchange rate issues, including 12 books.