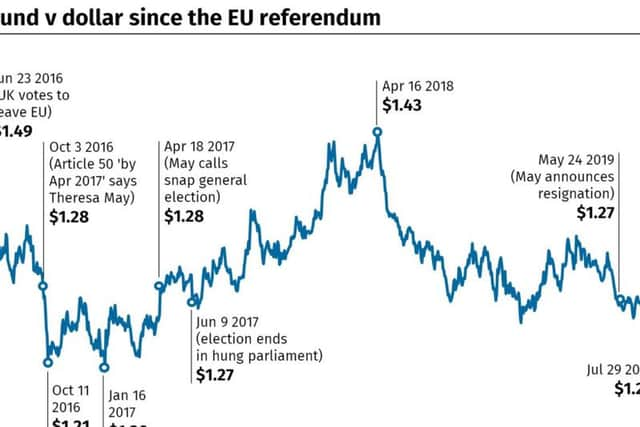

'Tory Brexit' blamed by SNP as pound plunges to 28-month low

Sterling is currently headed for its worst month since October 2016, when Theresa May announced her intention to trigger Article 30 ahead of the UK's exit from the European Union.

The pound dropped below $1.23 against the US dollar this week and fell sharply against the euro to below €1.10 on the international currency markets.

Advertisement

Hide AdAdvertisement

Hide AdSNP MP Patricia Gibson warned that Scottish holidaymakers now faced paying the price of the UK Government’s "damaging" Brexit strategy.

But Tory MP Robert Halfon suggested the fall in the pound could benefit exporters and help British tourism, while City analysts suggested the plunging pound was the result of the market coming to terms with Mr Johnson entering No 10.

“The Tories’ assault on people’s pockets and living standards has been ramped up as Boris Johnson pushes ahead with his catastrophic Brexit plans, which Scotland did not vote for and which we know will leave us all poorer and worse off.

“Rather than reversing the damaging consequences Brexit is already having - before the UK has even left the EU - the Tories’ flippant response by saying holidaymakers might stay in the UK instead of exploring different countries and cultures just shows how out of touch the Tories are."

Former Lib Dem leader Vince Cable said he was concerned the pound will fall further as traders wake up to the prospect of a no-deal exit in three months’ time.

"The markets already factored it in to some extent, but the potential for a continuing fall in currency is all too apparent,” he told Bloomberg.

Petr Krpata, an analyst with City bank ING warned that investors were now coming to terms with Mr Johnson's Premiership.

“The market [is] awaking to the reality of a new UK government, its rather combative stance on the current EU-UK Brexit deal, and its open remarks on the rising probability of a no-deal Brexit," he told The Guardian.