David Cameron denies going easy on Google boss

Labour leader Ed Miliband suggested the matter had not been brought up with Google chief executive Eric Schmidt at a gathering of a business advisory panel at Number 10 on Monday. Mr Miliband said: “He’s not putting concrete proposals forward on transparency, on transfer pricing, on tax havens, on tax avoidance rules. I think he did the wrong thing when he didn’t talk to Eric Schmidt about this on Monday.”

But, at a press conference yesterday, to herald a “breakthrough” in EU efforts to crack down on “aggressive” tax avoidance ahead of a G8 meeting on the subject, the Prime Minister said: “I raised the issue very directly as he [Mr Schmidt] is on my business advisory panel, and we discussed the G8 agenda, the tax multinationals are paying and I made sure there were proper contributions from people around the table, including him, on that issue.

Advertisement

Hide AdAdvertisement

Hide Ad“Aside from talking about it, what is much more important is taking action. What putting this at the front of the G8 agenda has achieved is a proper agreement, here in the EU to start with, that all countries should exchange tax information, that all countries should act on beneficial ownership, so we know who owns what.

“I think this is a big step forward.”

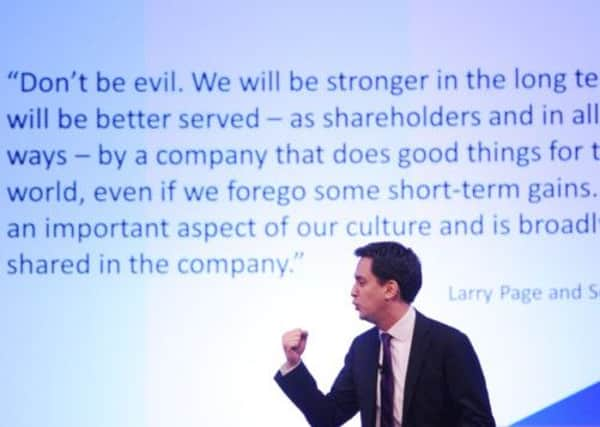

Miliband visits Google event to criticise company’s tax avoidance

ED Miliband has highlighted a “culture of irresponsibility” at some major companies, during an address in which he accused Google of going to “extraordinary lengths” to avoid paying taxes.

Mr Miliband – a keynote speaker at Google’s Big Tent event at the Grove Hotel near Watford – also highlighted the need for people to come together “for a common purpose” to create “responsible capitalism”.

He was speaking after reports that the firm paid only £10 million in corporation tax in the UK between 2006 and 2011, despite revenues of £11.9 billion.

Mr Miliband said: “I can’t be the only person here who feels disappointed that such a great company as Google, with such great founding principles, will be reduced to arguing that when it employs thousands of people in Britain, makes billions of pounds of revenue in Britain, it’s fair that it should pay just a fraction of 1 per cent of that in tax.

“So when Google does great things for the world, as it does, I applaud you. And when Google goes to extraordinary lengths to avoid paying its taxes, I think it’s wrong.”

Mr Miliband is understood to be keen to hold talks with Google chief executive Eric Schmidt, who last week came under fire from MPs over the firm’s efforts to shelter its multibillion-pound profits from UK taxes.

Advertisement

Hide AdAdvertisement

Hide AdAsked if he regarded big companies, such as Google and Starbucks, as “the banks of the past”, Mr Miliband said he saw some similarities. He said: “The banks caused a financial meltdown, which we are all paying for and will pay for for months to come. Despite my problems with Google, I don’t think they are about to do that.

“I have deep problems about the culture, and I think the culture isn’t that different to the culture we saw at the banks.

“I think there is a culture of irresponsibility among some of the biggest firms in the country, and that has got to change.”

“We can’t lecture people on benefits about doing the right thing and showing responsibility if at the same time some of the biggest companies are sending out the wrong signals to our country. That has to change.”

The Labour leader also stressed plans to harness the internet to transform the economy.

He said: “In particular making sure that power isn’t concentrated in a few hands, but we allow the smallest firms to flourish, enabling individual creators to work hand-in-hand both with the public sector and with global companies as they design the next generation of technology.

“That will only happen if the big firms don’t squeeze out their smaller rivals.”

He also spoke of the need to put creativity “at the heart of the education system”, accusing the current government of “downgrading its importance”.

Advertisement

Hide AdAdvertisement

Hide AdLib Dem MP Danny Alexander said tackling tax evasion was “an essential priority”.

He said: “As a coalition, we’ve made big progress on tackling tax evasion and tackling tax avoidance over the last three years. I think we’ve done more in these three years than Labour managed in their 13 years in office to make sure people pay their fair share of tax.”