Lawyers: War on tax avoidance may scare investors

MSPs will back new laws paving the way for the creation of a Scottish taxman today, when the Revenue Scotland and Tax Powers Bill is passed at Holyrood.

The Scottish Parliament will take over responsibility for the new Land and Buildings Transaction tax and the Scottish Landfill tax next year.

Advertisement

Hide AdAdvertisement

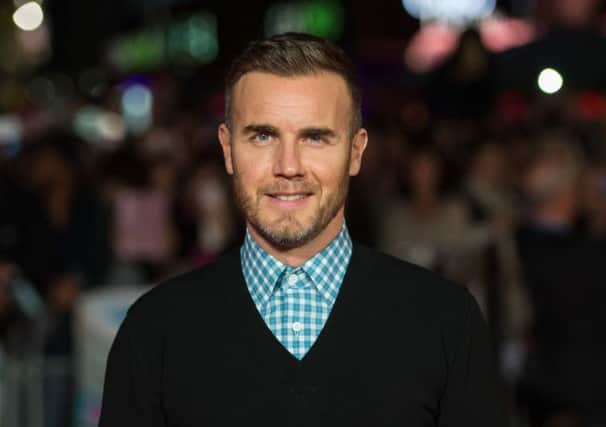

Hide AdTax avoidance has hit the headlines in recent months following a spate of cases involving celebrities, most recently Take That star Gary Barlow.

Finance secretary John Swinney says the new Revenue Scotland tax collection body will have an “anti-avoidance rule” at its core.

But the Law Society of Scotland yesterday warned that these risk being too broad and will lack certainty. Key to the concerns is Scotland having a broader definition of avoidance than the rest of the UK, which may put off investors.

Isobel d’Inverno, convener of the Law Society’s Tax Law Committee, said: “We support the bill’s intentions and are pleased to see the Scottish Government take steps to combat tax avoidance.

“However, we have raised concerns about such a broad definition of a General Anti Avoidance Rule (GAAR), which we think could lead to taxpayer uncertainty on how the rule would be applied.

“Ensuring taxpayer certainty will be essential, particularly to make sure that Scotland doesn’t suffer any commercial disadvantage.”

If firms are unclear about the tax regime it is feared they could decide to locate their operations outside Scotland.

The anti-avoidance rule aims to go further than the UK system, which deals with tax abuse, by tackling artificial arrangements designed to get a tax advantage.

Advertisement

Hide AdAdvertisement

Hide AdThe new Scottish system will include a General Anti Avoidance Rule (GAAR) to tackle avoidance of all taxes collected by Revenue Scotland. This has a broader approach than the UK’s system – General Anti Abuse Rule (UK GAAR) – and it is feared the Scottish approach could lead to confusion.

Elspeth Orcharton of the Institute of Chartered Accountants of Scotland (ICAS) has told MSPs that any lack of clarity on the Scots taxes could scare firms off.

“If more certainty is not given, businesses that are looking at property development or transactions or which are considering an investment might, in the absence of certainty, take their business south of the Border rather than invest in Scotland,” she told Holyrood’s finance committee in March.

An independent advisory panel should be created, according to the Law Society, to provide expertise on what contravenes the proposed tax avoidance rules rather than Revenue Scotland, sitting as “judge and jury” on its own decisions.

Although Revenue Scotland will only collect two sets of taxes initially, the SNP government says it will be responsible for collecting any further taxes devolved to Holyrood and would become Scotland’s taxman after independence.

Mr Swinney said last night: “There has been a wide degree of consensus across the political spectrum about the establishment of Revenue Scotland and our approach to the collection and management of devolved taxes. I am determined that Revenue Scotland will combat tax avoidance as vigorously and effectively as possible.”

Tax avoidance, which is not illegal, hit the headlines recently after Take That star’s Gary Barlow, Howard Donald and Mark Owen, along with their manager Jonathan Wild, were said to have invested £26 million in a scheme called Icebreaker 2.

Comic Jimmy Carr was forced into a public apology after admitting he was involved in the Jersey-based K2 tax shelter.

SEE ALSO