Independence: Currency union ‘in UK’s interests’

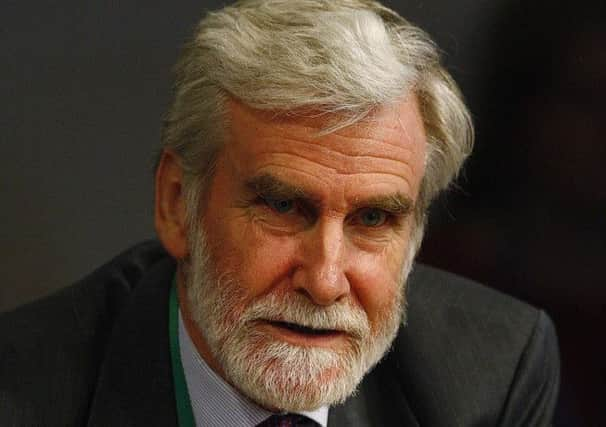

Professor Andrew Hughes-Hallett, a member of the Scottish Government’s Fiscal Commission Working Group, argues that with the prospect of a “tight” general election in 2015 it is “hard to believe” Westminster would veto such a deal when this “would make their own supporters worse off”.

The St Andrews University academic makes the case in a new e-book, which has been published by the Scottish Economic Society in the run up to the crucial ballot on September 18.

Advertisement

Hide AdAdvertisement

Hide Ad

Experts who have contributed to the book, titled the Economic Consequences of Scottish Independence, examine the merits of the various currency options facing Scotland if there is a Yes vote.

Prof Hughes-Hallett states: “Facing a tight general election in 2015, it is hard to believe the UK government would choose to deny a currency union when the consequences would make their own supporters worse off, but Scotland better off.”

He adds: “After the referendum, there will be no incentive for either side not to agree a currency union as long as effective fiscal controls are put in place on both sides. Since the Scottish fiscal position will be stronger (a smaller public debt ratio, and a budget surplus when national accounts are recalculated to reflect the changed flows of taxes and public spending as explained below) this would not be hard to arrange.”

But Professor Angus Armstrong and Monique Ebell from the National Institute for Economic and Social Research, argue Scotland could be heading towards “the option of dollarisation” - where an independent Scotland would use the pound without any formal agreement with the rest of the UK - if there is a Yes vote.

They state: “As we approach the referendum it appears that we are heading towards the option of ‘dollarisation’ almost by default. Yet this is an option that the Scottish Government’s Fiscal Commission Working Group does not consider a ‘clear option for Scotland’.”

As using the pound without a currency union would leave Scotland without the Bank of England as lender of last resort, the experts add that the “most likely outcome of dollarisation is that Scottish banks would migrate to the rest of the UK where they would have the backstop of a central bank”.

In such a situation they state that “UK banks would then provide banking into an independent Scotland through a branch network”.

Advertisement

Hide AdAdvertisement

Hide AdBut they claim this could leave Scots facing higher borrowing costs than the rest of the UK, arguing that “since the supply of loans into a foreign jurisdiction is generally a riskier proposition than at home, the cost of borrowing by private citizens is likely to be higher in Scotland under dollarisation”.

They add that while setting up a new currency for an independent Scotland “has serious transitional risks, over the long term it is the best option for prosperity for an independent Scotland”.

One of the editors of the new book, Professor David Bell of Stirling University, explained it had been published in a bid to ensure ordinary voters in Scotland have more information ahead of the referendum.

He said: “The referendum debate has been supported by a wide range of economic research that has often not been accessible to non-specialists. With this book, we seek to fill this gap.”

Anne Gasteen, president of the Scottish Economic Society said: “This book makes a valuable contribution to the independence debate for those with an interest in the finer detail of the economic arguments.”

A Scottish Government spokeswoman said: “Scotland is one of the wealthiest countries per head in the world, but we need the powers of independence to make the most of our huge resources.

“With the powers of independence we could do more to get people into work, and give employers the opportunity to grow their business, which would strengthen the economy and create jobs.”

A spokesman for the pro-independence campaign group Yes Scotland stated: “We are one of the wealthiest countries in the world, richer than the UK, France and Japan but only by taking Scotland’s future into our own hands can we use our economic strength to its full advantage and build a better, fairer and more prosperous country.”

SEE ALSO