Council tax freeze ‘worsens’ austerity for poor

The impact of swingeing spending reductions on vulnerable and disadvantaged groups is not being properly addressed by councils, the Joseph Rowntree Foundation report also said.

It warns that women, children and people with disabilities will be “disproportionately” affected because the current system of assessing need is no longer fit for purpose.

Advertisement

Hide AdAdvertisement

Hide AdThe report was compiled by researchers from Glasgow Caledonian University who spoke with five councils about the looming impact of austerity cutbacks on services and what effect current government policies – such as the council tax freeze – were having.

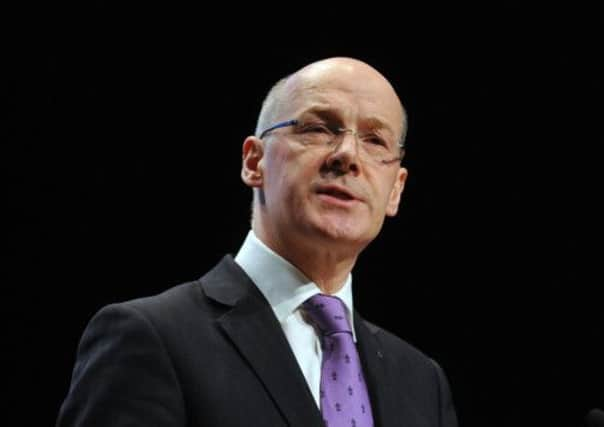

The council tax freeze was implemented by SNP Finance Secretary John Swinney when the SNP came to power in 2007, depriving councils of higher levels of income to spend on services.

The researchers say the freeze itself is damaging to low-income families.“The freezing of the council tax has not benefited low-income households eligible for full council tax benefit,” it says.

Instead, the government has been subsidising wealthier families who are not “vulnerable and disadvantaged” by not forcing them to pay higher council tax bills.“That lost subsidy could have been used to mitigate the social risks being faced by vulnerable and disadvantaged groups,” it adds.

But now any major hikes in council tax would effectively also be lost as the council tax benefit is clawed back from town hall coffers by central government, the report adds.

“Ironically, therefore, the council tax freeze appears to have exacerbated the public sector austerity in Scotland, will continue to do so even if it is abandoned, and has reduced the scope of councils to mitigate austerity-induced social risks by offsetting reductions in their grants by increasing their rates of council tax.”

Similarly, the groups who enjoy the main benefit of universal services, such as free university tuition and free personal care, are not the “vulnerable and disadvantaged”, the report finds. These groups don’t tend to send their youngsters to university and they already get financial support for free personal care.

“The universal nature of these free services does little or nothing to mitigate the social risks of austerity and may even increase them by diverting scarce funds from services of particular benefit to vulnerable and disadvantaged groups,” the report adds.

Advertisement

Hide AdAdvertisement

Hide AdBut a Scottish Government spokeswoman last night insisted low earners are the big winners from the council tax freeze. “The Scottish Government is delighted that we have been able to freeze the council tax in each of the last six years and that we have been able to support those on council tax benefit who faced being hit by 10 per cent from the UK government,” she said.

“In the current economic downturn, it has provided hard-pressed households across Scotland with some much-needed relief. The council tax freeze has helped ease financial pressure on all council tax-paying families in Scotland in tough times.”