Bill Jamieson: US poll could spell a choppy market ride

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

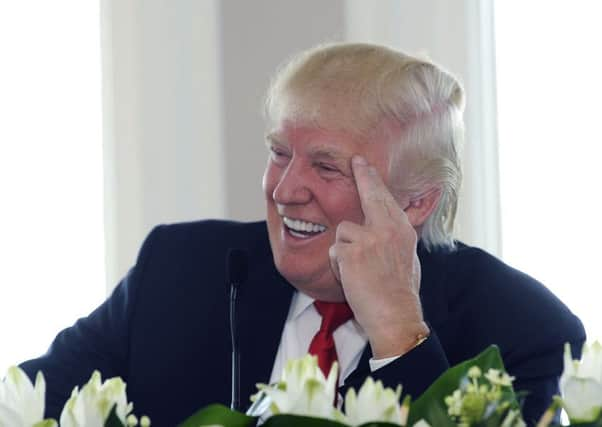

The prestigious Brookings Institution is forecasting a fall of between 10 and 15 per cent on Wall Street in the event of a Donald Trump victory.

US investors are already taking to the hills with nine successive daily falls in the S&P 500 – the longest string of declines since the global financial crisis of 2008. Money market funds are said to have absorbed more than $36 billion (£29bn) in the week to 3 November: a nervous dash for cash.

Advertisement

Hide AdAdvertisement

Hide AdWhile a win for Hillary Clinton still seems the likely outcome, markets are taking nothing for granted. After the Leave victory in the UK referendum caught most investors on the hop, few are in the mood to trust poll predictions, no matter how sure-fire they look.

The EU referendum result triggered an immediate sell-off on the stock market and in particular for the currency. Many fear a similar reaction if Trump triumphs – only the reaction would probably be more severe. And even that may pale into insignificance here if some of the worst forebodings for the UK market come true. According to hedge fund manager Crispin Odey, the UK stock market could collapse by 80 per cent.

Odey – whose ultra-bearish stance has already brought losses for many of his investors – blames the Bank of England for policies that have helped to inflate asset prices but have piled up enormous problems in the real economy, with a ballooning current account deficit and a rising budget deficit soon to follow. A Wall Street plunge in the wake of the presidential election result could well provide the trigger for such a collapse.

Investors can thus hardly be blamed for being on the edge of their seats for the next few days. Who would dare to make any investment in this climate or find it difficult to resist the temptation to sell ahead of such turbulence?

Now there’s little doubt that a Trump victory or a disputatious narrow win for Clinton would spark a sell-off. But there’s an eternal and yet still startling truth about markets that many overlook in such periods: investment is about more than the immediate tomorrow.

The aftermath of the UK Brexit referendum is a pertinent example. There was an immediate gut-wrenching sell-off in markets as investors contemplated the dire warnings of economic reversal and even recession that many including the Treasury had predicted.

But by mid-July, shares began to recover – both the globe-spanning constituents of the FTSE 100 and the more domestic-focused members of the mid-cap FTSE 250. Compared with the immediate post-Brexit plunge, the FTSE 100 Index is up by 13 per cent to stand at about 6,700, while the FTSE 250, feared to be the more vulnerable, now stands 15.3 per cent higher.

While there seems to be more uncertainty than ever over the shape and timing of Brexit, investors have noted that a weaker pound – long overdue in the view of most economists – will bring benefits for many UK companies, boosting export competitiveness and overseas demand for goods and services.

Advertisement

Hide AdAdvertisement

Hide AdThe vast majority of retail investors really should be taking a longer-term view: five years is a more realistic timespan for anyone contemplating stock market investment, not five days. Psychologically, of course, that’s easier said than done. The fear factor is a powerful determinant of investor behaviour. And over the coming days there will be saturation coverage of the election and its potential aftermath – little of it likely to be reassuring.

However, while there be much hand-wringing over the prospect of political deadlock in Washington, it should bring some comfort to investors. Trump has been campaigning on a high federal spending ticket, promising to outspend his Democrat opponent on infrastructure. But that is to reckon without an anti-Trump Congress, and in particular the deficit hawk Paul Ryan, current House Speaker: Trump’s more extravagant proposals would face a veto. That leaves the prospect of a more responsible, mild stimulus package, giving the Federal Reserve the headroom to raise interest rates in due course.

And bear in mind that the US economy is showing a strengthening recovery. The jobless rate fell to 4.9 per cent in October, matching the level in February 2008. Today most economic bellwethers are showing improvement. And of particular note is that hourly wages rose 2.8 per cent compared with a year ago. Investors should beware of treating Tuesday night as their time-span.