Five ways to beat April’s big bill shocks – Martin Lewis

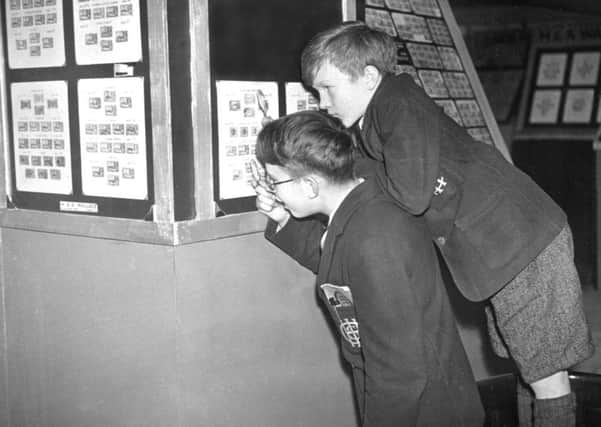

1. Stock up on stamps

Actually, before April – on Monday – the price of a 1st class standard letter rises to 70p, 2nd class to 61p. Large letters rise by even more. Stamps don’t have an expiry date, so if you’ll use them in future (eg, if you post lots of Christmas cards), stock up now.

2. You’re likely due a big hidden pay rise, but it’ll cost you

Advertisement

Hide AdAdvertisement

Hide AdEvery UK worker aged 22 or more, earning £10,000 plus, is automatically enrolled to pay into a pension alongside their employer. From 6 April, the total that must be contributed increases from 5 per cent to 8 per cent of salary, and the minimum your employer must contribute rises from 2 per cent to 3 per cent. That means that if your employer is only putting in the minimum, your contribution will rise from 3 per cent to 5 per cent (so £100 per £5,000 of salary). Though, as it’s from pre-tax income, each £100 you contribute only reduces your take-home pay by £80 as a basic rate taxpayer and £60 at the higher rate.

You can opt out of this, but I strongly suggest you don’t. While it does reduce your pay packet, if you contribute, your employer does too. So not doing so is giving up a pay rise – as it’s giving you money you wouldn’t have otherwise received (even though it’s not immediately usable). For far more help, see www.mse.me/payrisepaycut

3. TV licence fee to rise– but do you need one?

The colour licence increases by £4 to £154.50 from 1 April. So renew now if you’ve forgotten to, do it at www.tvlicensing.co.uk.

You need a licence if you watch or record TV as it’s being broadcast, or, specifically, the BBC iPlayer. If you only watch catch-up content on, for example, the ITV Hub or Netflix, you don’t need one.

Plus, if someone aged 75+ lives in your home, licences should be free. If not, and you’ve been paying unnecessarily, you can reclaim it (a whopping £38 million was refunded to over-75s from 2015-2018). Full help on that at www.mse.me/TVlicence

4. Council taxes up an average £75 a year – are you due thousands back?

The average council tax rise from 1 April in England (some a lot more) is to be 4.5 per cent, equivalent to £75 on a typical band D property. Rises are expected in Wales and Scotland too. However, up to 400,000 households in England and Scotland are in the wrong band. In 2007 I came up with the council tax check and challenge system, which allows you to safely check if yours is too high (don’t just speculatively challenge, or your band could be increased).

We’ve had 10,000-plus successes since, and you don’t just get your band lowered, you get a backdated refund too, as Susan emailed: “Refunded approx £3,000 and downgraded, so my monthly payments remain lower to this day. Thanks so much. This put us back in the black.”

Advertisement

Hide AdAdvertisement

Hide AdFree tools to do this are at www.mse.me/counciltax which also includes help on bill reductions for certain households:

– Do you live with someone with a severe mental impairment (SMI), eg dementia or severe learning difficulties? This likely affects up to 100,000, but is scarcely known about. Anyone with a qualifying SMI can be “disregarded” for council tax purposes, meaning a 25 per cent or even 100 per cent bill reduction.

Tom tweeted: “@MartinSLewis Thank you. After seeing you talk about council tax exemption, I’ve claimed back £9,650 for my dad who suffered a stroke in 1999 and has lived alone since 2005. This will make a big difference.”

– Moved since 1993? You could be owed £100+ in overpayments. More than £230m of credit should have been paid back. Live alone? You may qualify for the 25 per cent single person discount.

5. Energy prices rise 10 per cent due to price cap increase

From 1 April, the energy price cap on standard tariffs is rising from £1,137 a year for someone with typical usage to £1,254 a year. As over half the country are on these default tariffs, that means a chunky 10 per cent rise for most.

Cut costs by £300+ by switching to the cheapest supplier. It only takes five minutes via my www.cheapenergyclub.com (which also gives you cashback) or any www.ofgem.gov.uk approved site.

Martin Lewis is Founder and Chair of MoneySavingExpert.com. To join the 13 million people who get his free Money Tips weekly email, go to www.moneysavingexpert.com/latesttip.