Cohabiting couples are left out in the cold

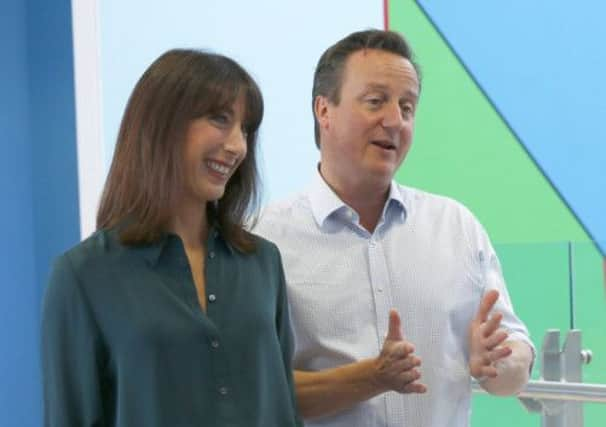

“There is something special about marriage: it’s a declaration of commitment, responsibility and stability that helps to bind families”.

These were the words of David Cameron when he announced a tax break to millions of married couples, including civil partners, to recognise that special “commitment and responsibility”.

Advertisement

Hide AdAdvertisement

Hide AdThere is no doubt David Cameron is fond of marriage. Not only has he spoken of his pride at having legalised same sex marriage this year, but he has also spoken of his plans to export same sex marriage around the world.

This comes at a time when marriage is on the increase again as statistics show that couples, on the whole, are happier being married to each other rather than simply cohabiting with each other. Good news indeed for wedding planners and wedding crashers; however, not such good news for those couples who still opt to live together, without any formal arrangements.

Sadly for them the law does not afford the same legal protection as that of married couples or civil partners, a fact which has recently led to calls for further reform of the way that the law treats cohabiting couples.

Legal status

One area where this is only too apparent is in the breakdown of the relationship where the difference in legal status is brought into sharp focus.

Married couples and civil partners enjoy far greater rights and protection if the relationship ends. Those rights are enshrined in the Family Law (Scotland) Act, in force since 1985, and in the Civil Partnership Act, introduced in 2004.

Financially, they will enjoy a right of aliment to reflect the change in circumstances, a right to child support should children be involved and a whole range of financial claims designed to ensure a fair division of any assets and liabilities.

Contrast this with the rights of cohabitees on separation. In such cases the law is in a state of uncertainty with limited rights having been introduced in the Family Law (Scotland) Act 2006. At present, this relatively recent legislation offers little certainty as to the eventual outcome of any claim.

Claims need to be agreed or raised in court within one year of the date the cohabitation ended. There are no such time limits for married couples. In addition, the orders the court can make for cohabitees are limited.

Advertisement

Hide AdAdvertisement

Hide AdIn such cases any money which the court orders to be paid is by way of a “compensatory payment” to address any “clear and quantifiable” economic advantage gained or disadvantage suffered by one party during the relationship, a resolution which does not always lead to a satisfactory outcome.

Children

When it comes to the rights in relation to children, happily the situation has at least improved for cohabitees. Unmarried fathers had no automatic parental rights (unlike mothers), until the law changed in 2006 to allow unmarried fathers registered as the child’s father to automatically obtain parental rights.

Another area where the lack of legal rights for cohabitees is brought into sharp focus is on the death of a partner.

If no will is left, a spouse or civil partner has a right to the house, furniture, and cash up to a certain value. Where a will has been left, but excludes the spouse or civil partner altogether, the law still allows them to make a claim on the estate for a set amount.

Cohabitees do not enjoy as much protection. Where a cohabitee dies without a will, the partner has six months to make a claim to the sheriff court for a share of the net estate. In order to make such a claim, the couple must have been cohabiting immediately before the death. The decision as to the amount awarded will be made by the Sheriff taking into account the length of time together, nature of the relationship, and any financial arrangements which existed during that time.

However, where a cohabitee leaves a will which does not benefit their partner, the partner has no right whatsoever to make a claim.

In addition, cohabitees do not enjoy any special inheritance tax treatment, unlike spouses and civil partners, who enjoy exemption from inheritance tax for transfers between them.

The answer? It has been said by some that until the law changes nothing quite protects parties like a marriage certificate.

Advertisement

Hide AdAdvertisement

Hide AdOn the other hand, it has been said that marrying is just all about obtaining a piece of paper and that divorcing is just obtaining another.

The solution? If walking down the aisle might seem a step too far, an easier walk for cohabitees might be to a legal firm to make a will and an agreement, laying out in detail the nature of their relationship. In doing so, they would be declaring that special “commitment, responsibility and stability” between them that makes their relationship so unique.

• Dianne Paterson is a partner in Russel + Aitken LLP www.russelaitken.com