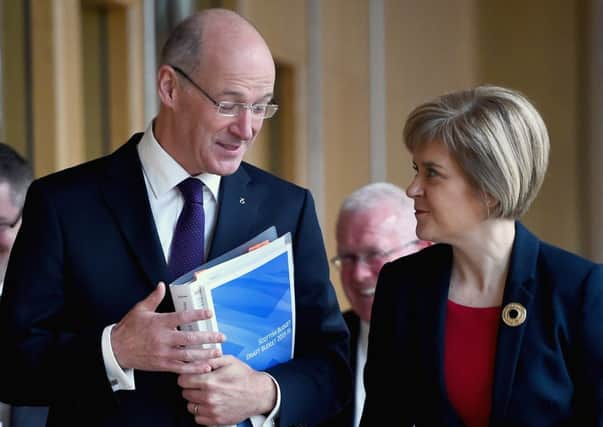

Budget analysis: Back to business for Swinney

Except that it wasn’t quite the same as previous budgets. The Scottish Government has gained new tax powers for the first time since the 1707 Act of Union.

The Landfill Tax will be charged at £82.60 for each tonne of taxable waste in 2015-16, the same rate as will apply in the UK as a whole. It is expected to raise £117 million, but by 2025 the intention is that it should not raise any money at all because by then the Scottish Government expects that Scotland will be a Zero Waste economy.

Advertisement

Hide AdAdvertisement

Hide AdThe second tax, the Land and Building Transactions Tax (LBTT), is expected to raise £441m in 2015-16. It replaces stamp duty and imposes more penal rates on higher value property transactions compared with current UK rates.

Houses up to £135,000 will be exempt from the tax, whereas properties which change hands at more than £1m will be charged 12 per cent of the value of the sale.

The whole idea of taxing property transactions doesn’t make much economic sense, though the Scottish Government has little option but to broadly follow the same structure as in the UK as a whole for the tax.

It may cool down the top end of the property market in Aberdeen and Edinburgh, but prices of lower cost properties may edge upward since the exemption from LBTT is slightly more generous than that for the existing stamp duty.

There were some other surprises in the budget: the amount set aside to cover public sector pensions was increased by a massive £1.2 billion. This item alone accounted for 60 per cent of the increase in the Scottish budget from £35.4bn to £37.4bn between 2014-15 and 2015-16.

However, public sector pensions are administered by the Scottish Government but paid for by the Treasury. Other Scottish spending is not affected by the need to set more aside to pay for public servants pensions.

Health spending will increase by 1.7 per cent to £12.2bn, a small real-terms increase. The Scottish Government has applied the “Barnett consequentials” arising from increased health spending south of the Border and added a little extra to enable a small expansion of resources going to the NHS.

Advertisement

Hide AdAdvertisement

Hide AdThough the overall training and employment budget will increase by 6.9 per cent, the Scottish Funding Council’s budget will be cut by 0.3 per cent, making life more difficult for colleges and universities. They will partly be compensated by an increase in student fees, which are paid for by the Student Awards Agency for Scotland and not, in the main, by students.

Given that the current UK government intends to continue its austerity programme until at least 2018-19, this budget will not be the last to try to juggle competing priorities.

At least the absence of large sporting events in 2015-16, regrettable though that may be for some, has also helped create some wiggle room for Mr Swinney’s eighth budget.

• David Bell is Professor of Economics at Stirling University