Be careful not to fall for the slick patter of claims firms

‘Have you been involved in a car accident? Did you suffer from whiplash or another injury? Then call this number now…” These adverts play constantly on daytime TV, luring the public to pick up the phone and start the claims process.

Such adverts might be annoying but claims management companies are also using an even more insidious form of advertising.

Advertisement

Hide AdAdvertisement

Hide AdMany people receive unsolicited texts or telephone calls saying money has been set aside for them following an accident, and inviting them to claim compensation.

Inducements, such as iPads, were at one time offered to potential claimants because the claims company could profit from selling the claim to someone else looking, in turn, to make a profit from whatever legal expenses the court might award them.

There are concerns that these aggressive marketing tactics are leading to an increase in the number of cases before courts north and south of the border.

Last August, a Miss England contestant was jailed for her part in a £3,000 car insurance scam. Amy Laban claimed to have suffered whiplash after an accident.

However, photos of her taking part in gruelling fitness tests and skydiving, suggested she had not been suffering as much as she claimed.

It was suggested Laban was “seduced” by a claims company, and that such firms are a huge problem. Recent experience of defending Scottish whiplash claims supports the seduction theory. We have questioned claimants in the witness box who testify that others have encouraged them to make a claim.

Some have even been surprised to learn, when cross-examined, that a letter of claim has been issued, purportedly on their behalf, within a couple of days of their accident and sometimes before they have seen their GP.

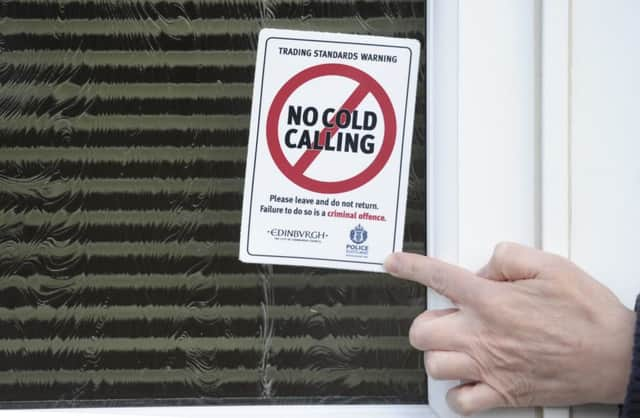

Those who regard cold calls as a nuisance rather than a seduction should welcome the recent introduction of caller identification rules compelling companies to display their numbers. This should make it easier for people to report companies to the Claims Management Regulator (CMR).

Advertisement

Hide AdAdvertisement

Hide AdThe CMR has started imposing hefty penalties following such investigations. A £220,000 fine was slapped on The Hearing Clinic following hundreds of complaints over speculative calls about claims for noise-induced hearing loss. Another company using automatic dialling technology to make 40 million nuisance calls in three months had its licence revoked by the CMR.

Questions were also raised after a fire at a woodchip board factory on Merseyside in 2011, resulting in more than 16,000 claims for breathing difficulties, yet all 20 test cases were dismissed. Many of the claimants had no idea a claim was being made in their names.

The judge referred two of the claims management companies involved to the Solicitors’ Regulation Authority for England and Wales.

What else can be done to stop Scotland seeing an increasing number of claims? Insurers can help by not offering compensation without seeing some supporting medical evidence and experienced law firms can be instructed to defend any claims brought to court.

• Kirsty Yuill is an associate at BLM in Glasgow

SEE ALSO