RBS to train one million people to identify bank scams by 2020

The Friends Against Scams training will be available to customers and non-customers of NatWest, RBS and Ulster Bank, helping them to understand how to spot a scam and arming them with information to help prevent relatives, neighbours and friends becoming victims.

With increased knowledge and awareness, people can make scams part of conversations with their family, friends and neighbours, helping to protect themselves and others, the bank said.

Advertisement

Hide AdAdvertisement

Hide AdNatWest was a founding partner of the Friends Against Scams scheme when it launched in 2016.

Currently 22,000 NatWest and RBS staff are Friends Against Scams ambassadors and this will be increased to 40,000 by the end of 2018 under the plans.

The training can be done face-to-face in branches or online.

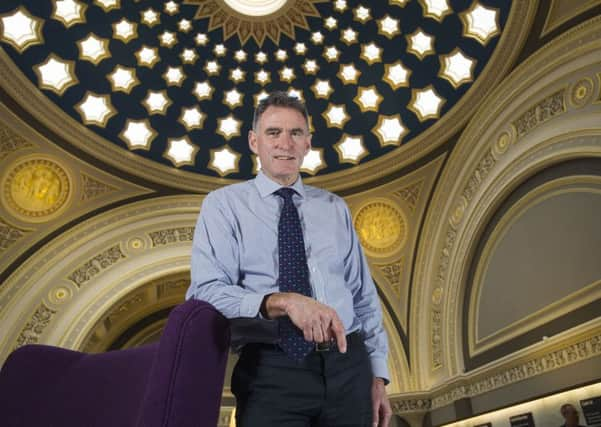

Mr McEwan said: “Friends Against Scams training has being incredibly beneficial to our colleagues and now I want customers and the public to be able to experience the benefits of the training too.

“Keeping our customers safe and secure is a bank-wide priority. Having trained 22,000 colleagues across the bank we are already seeing a real impact which has helped our customers avoid becoming victims.

“However, more still needs to be done and we are proud to commit to training one million customers and non-customers across the UK by 2020.”

Here are tips from RBS for people to remember when banking online:

1. Be vigilant. Just because someone knows basic personal details (such as names and addresses or even a customer’s mother’s maiden name), it does not mean they are genuine. Listen to your instincts – if something feels wrong then it is usually right to pause and question it.

Advertisement

Hide AdAdvertisement

Hide Ad2. Follow your bank’s security advice and never provide remote access to your device when asked to do so following a cold call.

3. Be cautious about what you disclose on social media and take precautions to ensure your details are only viewable to people you know.

4. Keep your mobile devices’ operating systems up-to-date to ensure that they have the latest security patches and upgrades.

5. A genuine bank or organisation will never ask a customer to transfer money for fraud reasons, or contact them out of the blue to ask for their Pin or full password. Stay in control and have the confidence to refuse unusual requests for information.

Last year Mr McEwan reportedly warned that victims of bank fraud should not expect automatic refunds.

He insisted it was not the responsibility of banks if customers gave their account details – or money – to online scammers, and said it would be too costly to cover all the losses.

He said: “We are working very hard to help customers detect when there are difficulties, but I think this has to be in partnership with the customer and with the bank.”