Alliance Trust hails results of '˜transformational' shake-up

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

The venerable Dundee firm, which last year struck a deal to sell its in-house investments arm to Liontrust Asset Management, said it delivered a total shareholder return of 10.8 per cent for the six months to the end of June, compared with a 6.4 per cent rise for the MSCI All Country World Index (ACWI).

Advertisement

Hide AdAdvertisement

Hide AdIts net asset value total return came in at 12.4 per cent, while its equity portfolio outperformed the MSCI benchmark by 4.2 per cent. The equity portfolio’s target is to outperform the MSCI ACWI by 2 per cent a year after costs over rolling three-year periods.

Today’s results come after a tumultuous time for Alliance Trust, which was founded in 1888. Last year it saw a Rothschild‑linked investment company walk away from talks over a potential £5 billion tie-up, having previously come under pressure from activist shareholder Elliott in a move that led to two of the rebel investor’s suggested non-executives appointed to its board.

Elliot’s demands for a shake-up of Alliance Trust’s operations and management also triggered the departure of chief executive Katherine Garrett-Cox and chairwoman Karin Forseke.

• READ MORE: Former Alliance Trust boss picked up £1.4m final pay

Having sold its investments arm, the trust has appointed eight external equity managers to oversee its investment strategy.

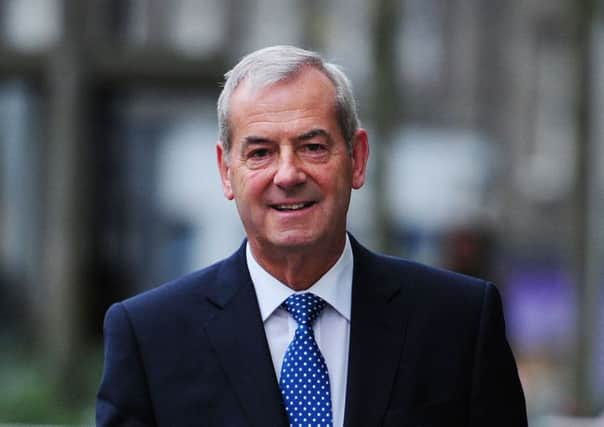

Alliance Trust chairman Lord Smith of Kelvin said today: “This has been a transformational period for the trust. We are pleased that the equity portfolio outperformed its benchmark against an uncertain market backdrop, all while transitioning to our new alliance of best ideas investment approach.”

He added: “We are confident that the trust will deliver attractive returns for our shareholders over the long term under the new approach, and are grateful to our shareholders for their support.

“Although it is still early days, the trust is demonstrating that it can deliver outperformance at competitive cost. We believe we have a compelling offering and look forward to investing for generations.”

Advertisement

Hide AdAdvertisement

Hide AdHowever, Smith also revealed that the firm’s Alliance Trust Savings (ATS) arm had failed to deliver a hoped-for profit despite enjoying a rise in customers and assets under administration, which now stand at more than £15bn – an increase of 11 per cent since the start of the year.

Higher costs were blamed for ATS racking up a loss of £1.5 million for the first half, compared with a £400,000 profit a year earlier, and it is expected to remain in the red for the year as a whole.