Omar Shaikh: Seize chance to be global HQ of ethical finance

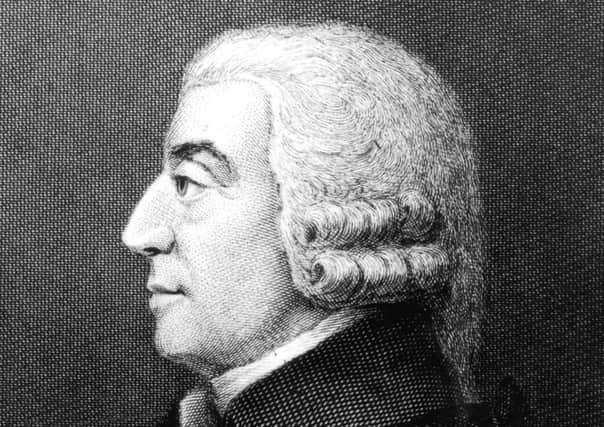

From Adam Smith, renowned as the father of modern economics, to the origins of the mutual life industry and the Reverend Henry Duncan, founder of the world’s first commercial savings bank, this nation has been a pioneer in financial innovation and the development of professional standards.

Ethical finance is certainly not a modern idea. But in the post-recession world, it is an idea that has never been more popular or needed. The failure of trickle-down economics to fairly distribute wealth and encourage inclusive growth, the damaging impact on the planet of the unchecked pursuit of profit, and the banking scandals of miss-selling and rate-fixing of the past decade have provided the context for the emergence of a new narrative.

Advertisement

Hide AdAdvertisement

Hide AdSociety is now increasingly desiring a more conscious form of consumerism and the emergence of the UN Global Sustainable Development Goals (SDGs) is fast providing a global unified target for measuring this rising trend. In addition, governments and senior politicians, including most recently First Minister Nicola Sturgeon, are realising traditional methods and measures such as GDP are not sufficient to capture wellbeing and that there is a real and immediate financial risk and cost of the climate emergency.

We are entering a new world, where innovation and alternative thinking will have a significant relevance in informing a new economic paradigm where finance is used for positive change serving an economy that works for all people and the planet. Whilst the contemporary circumstances are different, this challenge is not new as Smith referred to such facets in his earlier work, The Theory Of Moral Sentiments.

To foster this creativity, there is a critical need to encourage a broader narrative. And therein lies a unique opportunity to make Scotland, with its proud heritage, convene this pressing global narrative as the headquarters of ethical finance.

We have a robust financial services sector with strong ethical roots, and a strong culture of innovation, research and development, including a burgeoning financial technology sector in Edinburgh. We are a world leader in climate change and social enterprise, with a growing global reputation in ethical finance.

There is a collective desire to promote Scotland on the international stage as a global citizen and to boost trade and investment, influence and networks. Scotland is one of only a handful of countries to integrate the SDGs into its National Performance Framework, and soon the first Scottish National Investment Bank will become operational, with an aim to operate in an ethical and transparent manner.

That’s why the Global Ethical Finance Initiative, which has an international outlook, has chosen Edinburgh as its home, to work towards creating a new form of capitalism.

One of our main challenges is defining ethical finance, as there is no formal definition.

In simple terms, it is a fairer system of financial management that combines profit (as traditionally understood) with a purpose which at their heart have better outcomes for people and the planet.

Advertisement

Hide AdAdvertisement

Hide AdAnd why does it matter? Trust in banks is diminishing following the global crash and today’s generation of consumers – particularly millennials – believe that investment decisions should reflect the issues they care about. Ethical finance in the UK is valued at around £40 billion, so there are thousands of sustainable job opportunities that Scotland can capitalise on, particularly as the jobs market changes with the rise of automation and AI.

The world summit on ethical finance will be held in Edinburgh this year on 8-9 October. Bodies represented will include the United Nations, the Bank of England, the Scottish Government, the Financial Conduct Authority, RBS, Baillie Gifford and HSBC, with over 500 senior representatives from more than 200 companies and organisations from across the globe in attendance.

We will explore how to create a better system of financial management that delivers more than just profit. There is a growing desire to achieve this, and – when it happens – Scotland will have played a pivotal role in building a fairer world for everyone.

Omar Shaikh is managing director of the Global Ethical Finance Initiative