What is a Ponzi scheme? Meaning explained - how Bernie Madoff defrauded investors out of billions

Following the release of Madoff: The Monster of Wall Street on Netflix, some viewers may be curious as to exactly who disgraced financier Bernie Madoff was, and what a Ponzi scheme is.

This is what you need to know about Madoff and his Ponzi scheme, which was the largest in world history before it collapsed following the 2008 financial crisis.

Who was Bernie Madoff?

Advertisement

Hide AdAdvertisement

Hide AdStarting his financial career aged 22, Bernie Madoff quickly made waves in the industry when he launched Bernard L Madoff Investment Securities in 1960.

The firm was enormously successful and Madoff emerged as one of the biggest names on Wall Street, at one time serving as the chairman of the Nasdaq stock exchange.

Over the years the firm was investigated on several occasions for not making large enough returns, but it was ultimately the 2008 financial crisis that would foil the world’s largest Ponzi scheme.

When investors tried to withdraw their money from Madoff’s possession it was found that money was missing from their accounts. Corporate victims included a number of UK banks including the Royal Bank of Scotland and Man Group. High profile celebrity clients including Steven Spielberg were also impacted by the scam.

It is estimated that Madoff defrauded investors out of $64.8 billion. It is believe the scheme may have begun as far back as the 1970s

Madoff pleaded guilty in March 2009 to securities fraud and other charges, saying he was "deeply sorry and ashamed". Madoff was sentenced to 150 years in prison.

Madoff died at the age of 82 on 14 April 2021 at the Federal Medical Centre in Butner, North Carolina, apparently from natural causes, a person familiar with the matter told the Associated Press. In 2020, Madoff’s lawyers filed court papers to try to get him released from prison in the Covid-19 pandemic, saying he had suffered from end-stage renal disease and other chronic medical conditions, however the request was denied.

What is a Ponzi scheme?

Madoff’s Ponzi scheme was the largest in world history and the largest example of financial fraud in US history.

Advertisement

Hide AdAdvertisement

Hide AdInvestopedia defines a Ponzi Scheme as: “A fraudulent investing scam promising high rates of return with little risk to investors. A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors. This is similar to a pyramid scheme in that both are based on using new investors' funds to pay the earlier backers.”

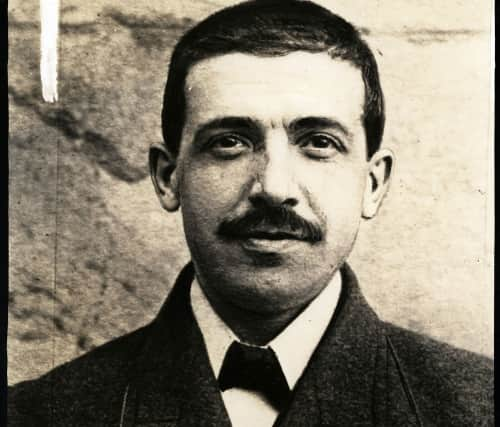

The term Ponzi scheme was named after Charles Ponzi, who in 1919 conned investors using the technique, promising them a 50% return within a few months for what he claimed was an investment in international mail coupons.

Ponzi used funds from new investors to pay fake “returns” to earlier investors.

With little or no legitimate earnings, Ponzi schemes require the constant influx of money to survive.

According to the US SEC (Securities and Exchange Commission) the following are tell-tale signs of a Ponzi scheme:

- High returns with little or no risk

- Overly consistent returns

- Unregistered investments

- Unlicensed sellers

- Secretive, complex strategies

- Issues with paperwork

- Difficulty receiving payments