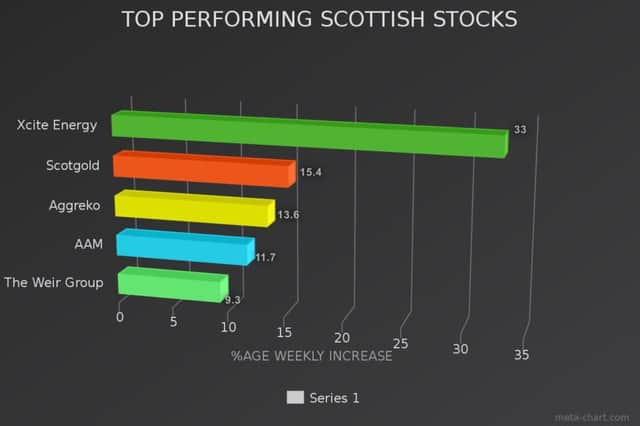

Top five performing Scottish stocks this week

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

Xcite Energy +33%

The Aim-quoted heavy oil appraisal and development company, which is focused on the North Sea, received a boost after the Oil & Gas Authority extended its licence containing the Bentley field until the end of June 2017. Xcite, which has its operational headquarters in Aberdeen, said Bentley is one of the largest undeveloped oil fields in the UK Continental Shelf, with “proved plus probable” reserves of 265 million stock tank barrels. The firm said the licence extension is expected to help secure the funding needed for its field development plan.

Shares closed at 12p on Friday 26 February, and at 16p on Thursday 3 March

Scotgold Resources +15.4%

Advertisement

Hide AdAdvertisement

Hide AdPlans to create Scotland’s first commercial gold mine, within the Loch Lomond and the Trossachs National Park, took a step closer to fruition when the firm asked for planning permission to start a bulk processing trial at its Cononish site. Chief executive Richard Gray said: “This is the most tangible and exciting development undertaken by the company since its incorporation.” Aim-quoted Scotgold added that early discussions indicate that gold produced from the trial could be sold “at a significant premium” because of its rare origins.

Shares closed at 0.65p on Friday 26 February, and at 0.75p on Thursday 3 March

Aggreko +13.6%

The Glasgow-based temporary power provider saw its shares surge despite a 13 per cent slide in annual profits and a warning that it expected to see a further fall in earnings this year. Investors were reassured by the group’s “continued confidence” in its prospects and its plans to deliver cash savings of £80 million by 2017. Cost-cutting plans have triggered 700 job losses from its global workforce, but chief executive Chris Weston said there had been no impact on its 450-strong Scottish headcount.

Shares closed at 887.5p on Friday 26 February, and at 1,008p on Thursday 3 March

Aberdeen Asset Management +11.7%

Shares in the fund manager rallied despite its demotion from the top-flight FTSE 100 Index in the latest quarterly reshuffle. Aberdeen has seen its share price fall by a half over the past year amid concerns over its exposure to emerging markets, although its most recent trading update showed a slowdown in net outflows from its funds, while assets under management topped £290 billion. The group, which has been on a recent acquisition spree, is looking to make further cost savings on top of a previous target of £50m.

Shares closed at 241.9p on Friday 26 February, and at 270.2p on Thursday 3 March

Weir Group +9.3%

Market rumours that a US rival could be eyeing a bid for the engineer saw its share lifted in the wake of results that showed its annual profits had almost halved. Glasgow-based Weir Group, which said it was facing “unprecedented” market challenges, is planning to cut a further £40m of costs this year, having delivered annualised savings of £110m in the year to 1 January as orders fell across the oil and gas and minerals sectors. Chief executive Keith Cochrane said: “Given ongoing market conditions, 2016 will be another challenging year.”

Shares closed at 933p on Friday 26 February, and at 1,020p on Thursday 3 March