Oil price slump: knock-on effects and prediction problems

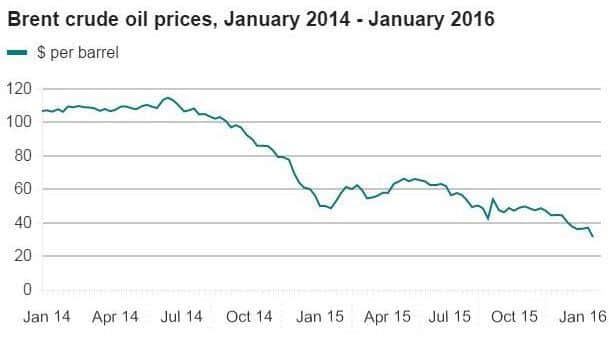

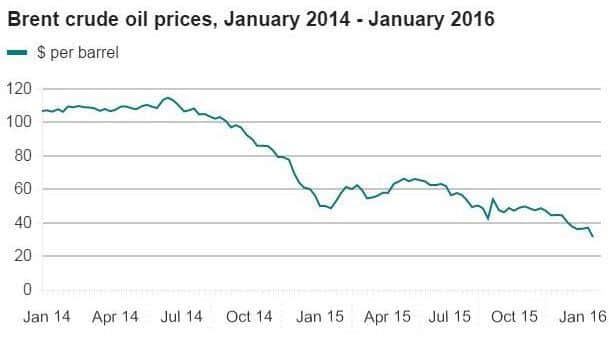

Since summer 2014, the price of a barrel of crude oil has fallen from $110 to just under $30 and has been accompanied by news of corporate belt-tightening and job cuts from several North Sea oil businesses.

The aftermath of the slump has not just been limited to the industry itself, as a steady decline in 2015 saw GDP grow by only 0.1 per cent in Scotland during the third quarter of last year. Compared to the rest of the nation, Scotland’s growth was 0.3 per cent lower.

Advertisement

Hide AdAdvertisement

Hide AdOne of the winners during the recent price crash has been the average consumer, as fuel prices have tumbled to as low as 97.7p per litre of diesel across the UK. Petrol has fallen slightly less - to 99.9p per litre - but the reductions have still resulted in fuel falling to its lowest price in 6 years.

This, in turn, lends credence to the idea that there are now more journeys on our roads and people have money to spare from family transport budgets. The resultant increase in disposable income has sparked health concerns that our nation is spending more on food and less on exercise. Recent research from a Robert Gordon’s University found that some UK workers are larger than average American males and take up more space than earlier data had indicated.

Effects of a low oil price

Professor Alex Russell is Head of Department of Management and Professor of Petroleum Accounting at Robert Gordon University’s Business School. He said: “I have noticed a lot more houses going up for sale in Aberdeen.

“It used to be in wealthy areas such as Cults that houses would be sold in a matter of days, but now we have expensive properties of over £1m staying up for sale for over a year,

“The view from the Bank of England is that [a lower oil price] is good news in the main for the UK, as the cost of living goes down and it might spur people into starting their own business because it’s cheaper to do so.

“But it’s a potential nightmare situation for those who have paid over the odds for their houses as they could end up with negative equity. “There’s a potential for falling housing prices to have a knock-on effect throughout the UK, as people are forced to move to find suitable housing.”

Despite the negativity surrounding those selling on the housing market, falling house prices should make it easier for those wishing to get onto the housing ladder or to upgrade their property.

Advertisement

Hide AdAdvertisement

Hide AdProfessor Karen Turner is Director of the Centre for Energy Policy at the University of Strathclyde International Public Policy Institute. She specialises in assessing the economy-wide impacts of energy and climate policy that boom and bust periods bring.

Professor Turner said: “You can often predict the direction of change, but not the magnitude. You’re talking about a commodity where the price is affected by things that are difficult to predict, such as wars or nations like Iran stockpiling oil.

“It’s said that for every job directly involved in oil and gas in Scotland, you have approximately nine linked to them in the wider economy.

“These ripple effects from job losses will disrupt these jobs, but those in Edinburgh and Glasgow may not notice the pinch in the same way as those in Aberdeen, for example.

“We are talking in terms of immediate consumption - people may increase visits to the cinema or restaurants for example, but uncertainty over how long prices will stay low for will affect people’s spending habits and so they may not make big purchases.”

Professor Russell, in addition, believes that lower house prices will be short-lived, as the long-term negative effects of a low oil price on the UK far outweigh the minor relief for consumers provided by the slump.

How low can it go?

With so many competing factors at play, even the industry itself finds it near-impossible to predict how the oil price will react in future.

The Brent crude oil price currently sits at below $28 a barrel and some analysts have predicted it could further still.

Advertisement

Hide AdAdvertisement

Hide AdMorgan Stanley said that “oil in the $20s is possible”, if China devalues its currency further, economists at the Royal Bank of Scotland say that oil could fall to $16 while Standard Chartered predicts that prices could hit just $10 a barrel.

A spokesperson from industry representative Oil and Gas UK said:

“What is apparent is that the sustained drop in oil price over the past year has loaded extra pressure onto companies already grappling with the challenge of operating competitively on the mature UK Continental Shelf (UKCS), a basin which at the same time is addressing the acute cost inflation of recent years.

“Predicting the future price of oil is something that’s very much in the domain of economic and financial analysts who study the global crude oil price market rather than the UK oil and gas industry’s trade association.

“With factors as wide-ranging as the global economy, geopolitics and geology to consider, their job is undoubtedly very difficult, and the oil price – as we’ve observed over the last 18 months – is notoriously hard to predict.”

Historically-speaking, oil supplies in global markets have been reliant upon Organisation of the Petroleum Exporting Countries (OPEC). OPEC traditionally withhold supply if the oil price started to fall to create market demand.

But this model has been complicated by the emergent economies of China and Russia, as well as conflicts in the Middle East in areas that have been traditionally oil-rich, such as Libya or Afghanistan.

Professor Russell added: “The complicating factor is that in normal times, Saudi Arabia and the USA would work hand in glove as mutual enemies of Russia and Iran.

Advertisement

Hide AdAdvertisement

Hide Ad“With America stockpiling their own oil, they have stopped importing from Saudi Arabia, with the Arab nation losing market share and producing more oil to force the price downwards.”

“The US can also cut back on fracking without any real consequence - no-one predicted the fall in the oil price because of Russia invading the Crimea and Ukraine.”

“What’s in the interest of these companies is not necessarily in the interest of Scotland or the UK. They’ve got to think long-term to defend against these problems in future.”

A report issued by Energy minister Fergus Ewing insists that the industry can improve and that the value of its supply chain can increase from £22 billion to £30bn by the end of the decade if demand from Asia and the Middle East is met.

Asia and the Middle East are seen as key overseas markets that could help boost international trade.

The Scottish Government have launched a new oil and gas strategy in February 2016 calling for a transformed supply chain to drive efficiency, innovation and internationalisation to ensure a long and vibrant future for the sector.

The strategy also sets out plans to see Scotland ranked in the top three countries globally in terms of innovation and technology development for the sector – even after the pilot light on the last North Sea oil rig has been extinguished.