Scots pioneer new measures of online financial security

Daniel Broby has no doubt about the biggest opportunity presented by fintech; overhauling the backbone of the financial services industry in the most fundamental way.

“There is so much going on with fintech SMEs and around informatics that some people are ignoring the major opportunity,” says Broby, director of the Centre for Financial Regulation and Innovation at the University of Strathclyde, the first university to offer a specific qualification in fintech.

“Finance and technology are converging online – and as a result, we are effectively moving the backbone of the financial system from a centralised ledger held by single banks to a decentralised one over the internet,” he says.

“This has a number of consequences; information is no longer sitting in one place, so there is multiple storage and an explosion in data, which we call big data.

“This leads to an increased focus on security. Protecting one ledger behind a firewall is very different to protecting multiple ledgers that are open to everyone.”

Broby stresses the need to ensure that financial records are immutable.

He says: “What are the back office functions in finance? They are the record-keeping of financial assets and, to carry out those functions over the internet, you need to make those records immutable, so they cannot be changed.

“This is leading to transformational change in the platform – and mechanisms – used for financial services.

“It’s not just digi-cash, it’s the backbone of the entire financial system.

“That’s the fundamental fintech vision, not simply delivery or data or a business opportunity.”

Broby thinks Scotland must follow the fintech fundamental path: “We have 10,000 people working in financial institutions in Glasgow alone, mainly in the back and middle office, and these areas will be transformed by fintech.

“That’s where Strathclyde wants to focus its energy and budget, to ensure those future jobs come to Scotland and not elsewhere.”

Broby has spoken before about the threat to jobs (perhaps as many as 15,000 in Scotland, he suggests) and insists this challenge must be used to deliver transformative change.

“Job losses are inherent in fintech and are often not spoken about because they are a negative.

“If financial records in the new system must be immutable, there is less of a requirement for reconciliation processes at individual financial institutions.

“That means fewer jobs in the back and middle office, as well as in risk management, because those jobs are really about managing data.

“However, if we take the opportunity, there is a positive side. The reconciliation still needs to happen somewhere and we need to think about how we can do that here in Scotland.

“There’s also a raft of new jobs coming that many people haven’t thought much about – such as editing of digital programme code [to ensure money transfer protocols are correct].

“And there will be a host of newly-created jobs focused on the interface of how we deliver financial services – mobile apps, APIs (application programming interfaces) and the like.”

So how are Scotland’s large financial institutions reacting to this existential threat to their backbone?

“The problem is that the incumbents [the existing big banks] do not have the incentive to implement change as quickly as the challengers,” says Broby.

“The danger is that large financial institutions elsewhere will gain a competitive advantage by moving more quickly.”

However, he sees positives: “RBS is one of the leaders in fostering innovation in the sector and cooperating with SMEs in fintech and JP Morgan is leading on the re-invention of technology for its 1,600 staff in Scotland; they really get it.”

Broby is adamant that retraining existing financial services staff is the number one priority, which might seem strange coming from a senior figure at a fintech pioneer university. The MSc in financial technology was launched in September 2017 and as the first group of 32 students approaches the end of the year, a new cohort is being recruited for this autumn.

“With the likes of Data Lab, the universities and Government initiatives on fintech, we are doing well at preparing the next generation to come into the industry,” Broby argues.

“But we are not retraining the incumbents, those who are in the financial services jobs now – that’s the big one.”

Strathclyde University is seeking to address this after gaining funding for a MOOC (massive open online course), which could train up to 20,000 people.

“This is a free course which will teach people about the role of data in fintech, and it should be up and running this year,” says Broby.

“It’s the first course of its kind in the UK, funded by the Data Lab, and it will help to retrain those incumbents in new ways of doing things – and also showcase Scotland’s capability in this area. We are working out how best to provide the support needed for those taking this course.

“You get the most from it if someone guides you through it. We’re looking at using tutors based in companies and in universities to offer that guidance. It is imperative that larger employers get on board with this.”

Broby also stresses the significance of industrial engagement in the universities. “We have had guest lecturers from companies like Previse and Castlight, as well as Morgan Stanley, ScotCoin, the Financial Conduct Authority and Bank of England.

“It’s crucial that students get real-life experience and I’m delighted that many have taken up the more difficult option for their dissertation by working with businesses.”

Broby is also optimistic that those MSc fintech students will have many opportunities as they emerge into a world where Scotland is a genuine global player.

“Stephen Ingledew at FinTech Scotland is a very driven person and it’s good to have that focal point to lead the rallying charge and to have support from the First Minister down,” he says.

“The size of Scotland works to its advantage; the decision-makers all know each other and that can help us move a little faster than the others. Scotland has already made great strides forward: the creation of FinTech Scotland, the ability to attract companies and the creation of more outsourced jobs.

“We are definitely going in the right direction, but over the next 12 months we need increased scale on all fronts.

“Instead of 32 Masters students, we need 100 – and more PhDs. Instead of SMEs, we need larger companies. And we need genuine collaboration.”

Broby recognises that there is also a fundamental requirement for public confidence as the backbone of financial services is reshaped and open banking becomes a reality: “There are two constants that define banking – trust and security – and that cuts to the core of what we do and what fintech is.

“If there is a failure in either trust or security, fintech will get a bad name and there will be a Luddite reaction to it. We have evolved from the concept of fintech and now we are getting to the implementation. At this point, we must ensure what we have in place is robust.

“For sure, there are going to be scandals and security breakdowns – there always are with money so we need to separate the concepts of value to society and of value to businesses and/or individuals.

“If we can do it right, the public will get a lot out of the success of fintech – faster, more efficient and cheaper financial transactions.

“This is a serious transformation of the financial business model – it results in disintermediation, which means effectively cutting out the middle man.

“This puts existing banking methods under threat and, while costs are reduced for customers, risk becomes a more important factor.

“Consumers need to see how trustworthy these new platforms are.”

“Some of the brightest students I have ever seen.”

The first 32 students on Strathclyde’s MSc in financial technology have not disappointed Daniel Broby and his colleagues.

“They are some of the brightest students I have ever seen – extremely motivated and very innovative in the ideas they are pushing,” he says.

Broby adds that Strathclyde is already learning from the first year of the MSc.

“We tried to introduce programming to them slowly as a sort of build-up, but it’s a tall order expecting them to learn the theory of finance, programming and analytics.

“We will bring forward the introduction to programming next time so students have more time to get familiar with it.”

The course is also being refined to reflect the different types of students signing up.

“There are the entrepreneurial types, those who want to go down the technology track and those who want a front office role in the finance sector.

“We are developing a core module which allows the students to go down a specific track depending on their personal interests,” says Broby.

“There are different views on what the fintech sector wants to come out of the universities, but my view is that we most need generalists who have a view across technology, finance and business.

“They don’t need to be brilliant across all areas, but need to know what to look for. That applies whether they end up working for a large financial institution or an SME.”

Strathclyde’s MSc in fintech was designed on the advice of Skills Development Scotland.

“They said we had a skills gap and that if we were to succeed in fintech, we had to provide a multiple skills set to fill that gap,” says Broby.

“There is no point in just creating a very theoretical course and hoping people apply. We position ourselves as a very practical university.”

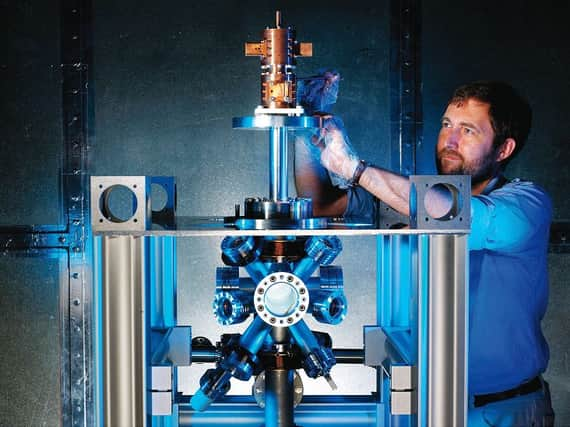

Atomic clock adds accuracy

A collaboration between Strathclyde University and the National Physical Laboratory (NPL) uses an atomic clock to time-stamp online data with incredible precision (at the nanosecond level).

This means, for example, that as financial transactions migrate from single banks to the internet – part of the fundamental change in the backbone of the system described by Daniel Broby – they can be time-stamped in an incredibly accurate way.

This can prevent “front-running” – a way of gaining advantage in the financial markets by accessing information before rival traders.

Broby says: “This atomic time-stamping of financial data is one of the areas where the UK is a genuine world leader.

“Strathclyde is the only UK university with a relationship with the NPL, which is headquartered in Teddington, Middlesex, but also has a base in Strathclyde’s TIC building.”

For more information about the University of Strathclyde Business School, visit their website