BLME launches asset finance firm Carrick for SME funding

Carrick Asset Finance, a new entrant to the UK business asset finance sector, launched yesterday with support from the Bank of London and the Middle East (BLME).

It aims to help SMEs release capital tied up in their assets or acquire business critical assets, through products and services including hire purchase, lease purchase, finance lease, sale and lease back.

Advertisement

Hide AdAdvertisement

Hide AdBLME, a Sharia’a law compliant bank, cited asset finance as a central part of its strategy, and “critical to the success of SMEs”.

The Carrick business will be based in Glasgow but will deal with brokers and customers across the whole of the UK.

According to the British Business Bank, more than 65 per cent of SMEs sought finance during the past three years, with over one third of these companies using lease or asset-based finance, which tended to come from non-bank sources, such as asset finance companies.

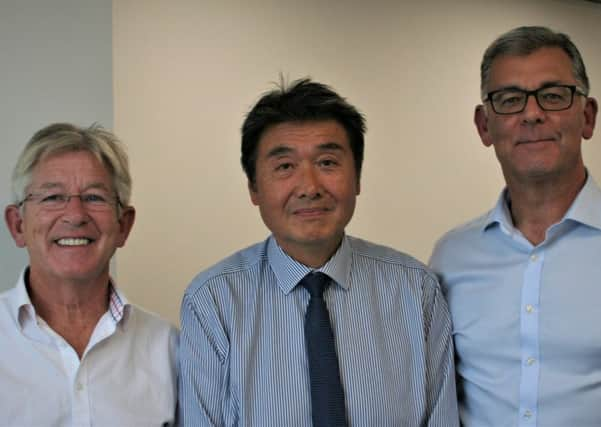

Fred Yue, head of corporate banking for BLME, said: “The asset finance market is buoyant in the UK and there are considerable opportunities for asset finance companies.

“With our funding, the experienced team at Carrick will be well placed to access these opportunities by providing customer-focused asset finance to customers directly and via brokers.

“We look forward to working with the management team and believe they will provide a much needed source of lending to the SME market.”

Carrick’s management team includes Gerard Moon and Iain Corbett, who have more than 50 years’ combined experience in the leasing sector and at asset finance start-ups.

Moon said: “The relationship with BLME has been established for a number of years and we welcomed the opportunity to develop a partnership with them.

Advertisement

Hide AdAdvertisement

Hide Ad“They have been proactive and helpful throughout the negotiations and we are pleased with their flexibility and the breadth of the BLME funding arrangement.

“Our priority now is to get out there and let our broker contacts hear about all that we have to offer.”

Corbett added: “Our overarching objective is to be much more than just another funder, it is to become a true business partner.

“We will work with a small, targeted group of brokers where we will invest time and effort to really understand their financing needs, building a strong partnership with them.

“Our team in Glasgow will work to a high level of service, providing a personalised approach to each and every customer and transaction.

“This is a very exciting opportunity for everyone involved.”