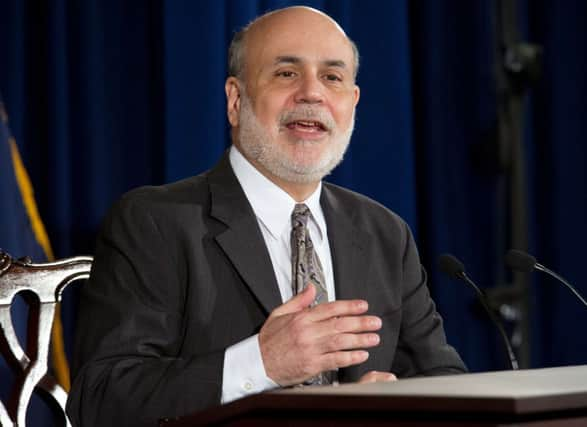

Bernanke bowing out with $10bn bond buying cut

The Fed also reaffirmed its plan to keep short-term rates at record lows in a statement after Ben Bernanke’s final policy meeting – he steps down tomorrow after eight years as chairman, with Janet Yellen taking the helm.

Most economists expect a string of $10bn monthly reductions in bond purchases at each Fed meeting this year, concluding with a $15bn cut in December.

Advertisement

Hide AdAdvertisement

Hide AdThe bond purchases have been intended to keep long-term borrowing rates low to spur spending and growth. The Fed’s decision last night to continue paring its purchases signals its belief that the economy is showing consistent improvement. In its statement, it upgraded it assessment to say “growth in economic activity picked up in recent quarters”.

Stocks fell after the Fed announced its decision, The Dow Jones industrial average tumbling 189.71 points, or 1.19 per cent, to end at 15,738.85. Bond prices were little changed.

“Ultimately, the Fed sort of had no choice but to reduce purchases,” said Dan Greenhaus, chief strategist at BTIG brokerage. “If they had paused, they risked sending a signal to markets that they lacked conviction.”

Yesterday also saw South Africa’s central bank unexpectedly hike its interest rates in response to the weakening rand, but the currency fell to a five-year low against the dollar.

The increase, which governor Gill Marcus said was aimed at stabilising the currency, followed the decision by Turkey’s central bank on Tuesday to raise rates sharply. Turkey’s bold action stunned investors, sending the lira higher and driving a broad revival in global risk appetite, but it raised the prospect of Turkey missing its 4 per cent growth target this year.