Son of man with terminal cancer in charity head shave

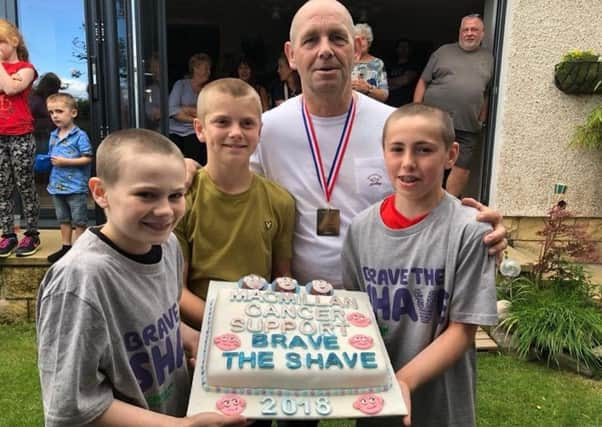

Robby Bain (12) and two of his friends from West Lothian Gymnastics Club – Ryan McGeorge and Lachlan Brown – had their hair shaved completely off by their coach John Campbell at Robby’s home last Saturday.

His dad Robert Bain (45) was sadly diagnosed with terminal cancer in 2015, shocking the family, who run Apache Services in Dalkeith.

Advertisement

Hide AdAdvertisement

Hide AdNow Robby and his teammates hope to raise as much money as possible for Macmillan Cancer Support’s Brave the Shave campaign.

Robby’s mum Sharlene Bain (43) spoke of her pride at her son for taking part in this charity event last weekend.

She said: “Robby came up with the idea to do something to raise money for cancer charities. His dad has got lung cancer which is obviously incurable. Robby really wanted to do something to help.

“I’m really proud of him. Everything my kids do makes me proud.

“They are so supportive of their dad and try to encourage him, keep his spirits up. That’s what is keeping him going.

“So we decided to have a barbecue at ours and the boys had their hair shaved off by their coach. I didn’t want Robby to shave his hair, but it will still grow back and they are raising money for a great cause.”

Sharlene was glad to see her son’s teammates join him.

She said: “They are all very keen gymnasts from the same club. The boys at the club are like family. And they wanted to support Robby.

“Their coach John, who is by no means a hairdresser, shaved their hair.

Advertisement

Hide AdAdvertisement

Hide Ad“He had been winding them up all week saying that if they didn’t train well he would mess up their hair!”

Sharlene revealed more about her husband’s condition.

She said: “He was diagnosed three years ago. He had eight weeks of chemotherapy and radiotherapy.

“Unfortunately, the cancer spread into his spine.

“Doctors didn’t give him long to live. They put him on immunotherapy, which slows the cancer down but doesn’t kill it obviously.

“He comes off that in December, in the hope that his body takes over a bit.

“So he has now had an extra year and a half on top of what he was originally given to live.”

Robby has been supported by his older brother Tony (14) and younger sister Mirin (10) in his charity head shave, as they come to terms with their father’s terminal illness.

Despite this devastating diagnosis the family continues to run its business on Tait Street.

Sharlene added: “It’s been a massive change to our lives.

“We are still felling so empty and powerless to help him.

“Robert has just worked right through it. And he also manages to go the gym three times a week.

Advertisement

Hide AdAdvertisement

Hide Ad“On really bad days my dad, who originally owned the business, comes out of retirement to come in and cover.

“It’s great. The family has really come together.”

Robby has quickly raised £640 for Brave the Shave.

To support Robby and his friends’ charity head shave, click here..